This report presents the complete results of a special Coalition Greenwich study on sustainable investing. In Q1 and Q2 2023, Coalition Greenwich interviewed 143 pension funds and endowments and foundations (E&Fs) in North America and Europe about sustainable investing. From the results of that research, we identified a series of factors that are influencing the evolution of sustainable investing around the world.

These factors, which we examine in detail, include emerging best practices such as the full integration of sustainability into institutional investment processes and portfolios, the growing expectation for investment returns on sustainable investments to meet or beat assetclass benchmarks, an increasing awareness and commitment to screen out greenwashing, and the broad use of thematic strategies to enhance both investment performance and impact.

The research results also identify two key variables that could slow the future growth of sustainable investing: a lack of consensus on how to measure impact and increasing regulatory uncertainty.

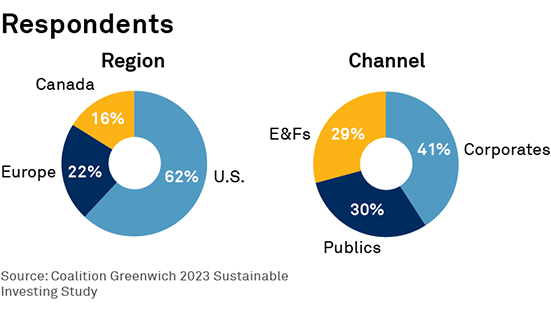

MethodologyFrom March through April 2023, Coalition Greenwich conducted 143 telephone and online interviews targeting corporate pensions, public pensions and endowments and foundations based in North America and Europe to examine overall trends of investor attitudes on key aspects of sustainable investing and identify differing perspectives and approaches within it.

The study that this report is based on was commissioned by AGF Investments and conducted by Coalition Greenwich, a division of CRISIL.