Announcing the 2018 Greenwich Excellence Awards for Large Corporate Trade Finance... More than 270 banks were evaluated and six had distinctive quality...

Announcing the 2018 Greenwich Excellence Awards for Large Corporate Trade Finance... More than 270 banks were evaluated and six had distinctive quality...

While it remains too early to assess the exact impact on the world’s economy, trade disputes and new trade barriers are adding uncertainties for corporates worldwide and are likely to have an impact on the broader trade finance landscape.

The U.S. corporate banking market is on the cusp of a revolution, with relationship strength and wallet allocation increasingly driven by effective process digitization.

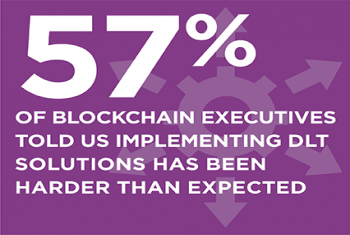

In this report, we look at some of the key technical challenges executives are facing and analyze their approach to solving them.

Announcing the 2018 Greenwich Excellence Awards for U.S. Large Corporate Finance... More than 70 banks were evaluated and seven had distinctive quality.

Explicit unbundling of research/advisory payment and “best execution” moved to the fore after MiFID II’s implementation in January 2018.

Fixed-income dealers that invested in their businesses over the past year are positioning themselves to capitalize on an anticipated pickup in market volatility and investor activity.

RBC Capital Markets and TD Securities are deadlocked atop a newly competitive Canadian fixed-income market.

Institutional assets available to asset management firms in Asia topped $3 trillion for the first time this year, as central banks, large pension funds and other institutional investors continued diversifying their portfolios and outsourcing assets...

U.K. investment managers are working to maintain and enhance profit margins in the face of downward pressure on management fees.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder