Download the full report using the link above.

Summary

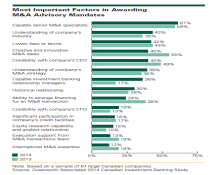

Canada’s biggest banks retained their tight grip on the mergers & acquisitions, equity capital markets and debt capital markets business of the country’s larger companies as of mid-year 2014.

Meanwhile, these banks looked to expand their dominant positions in corporate domestic cash management into the international arena by making big investments in cross-border technology platforms and taking aim at the foreign banks that capture a significant share of this growing business.

MethodologyBetween May and July 2014, Greenwich Associates conducted interviews with chief financial officers, corporate development officers and treasurers at large Canadian corporations.

Interviews were conducted with 255 executives in debt capital markets, M&A and equity capital markets. Topics included market trends, fees, selection criteria, compensation, and service provider assessments.