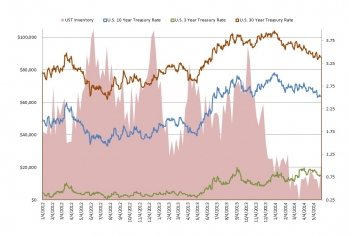

Those of us tracking the broader fixed income market have become quite familiar with the chart showing dealer inventories of corporate bonds falling through the floor, but this chart of bank US Treasury holdings totally blew me away.

Those of us tracking the broader fixed income market have become quite familiar with the chart showing dealer inventories of corporate bonds falling through the floor, but this chart of bank US Treasury holdings totally blew me away.

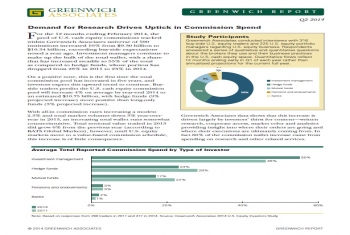

We've just released the results of our benchmark US equities study, based on almost 600 interviews with US equity investors. While Greenwich has been conducting this study for literally decades, this is my first market structure analysis of the...

Over the past decade or so, the growth of OMS and EMS platforms has paralleled the growth of electronic trading – but it would be a stretch to suggest a direct cause-and-effect relationship. These days, though, given the growing importance of...

Bloomberg TV ran a segment on cheaters - who cheats, why people cheat and how to get them to stop cheating.

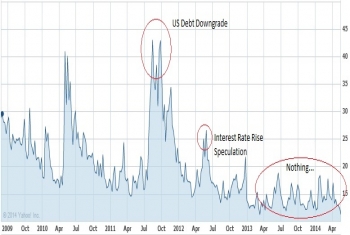

I'm a little obsessed with volatility lately - well, the lack of it actually. The VIX has been hovering around 12 for months despite emerging markets turmoil, rigging scandals and regulatory environment that can only be described as volatile. How...

Liquidity in the corporate bond market is tough. We've written about it time and time again. At a high level we see two solutions. One, inject new electronic trading tools and liquidity providers into the existing corporate bond market to better...

On Thursday May 1 the CFTC released an eagerly awaited clarifying document outlining when and how package trades would be required on SEF. Packaged transactions will be phased in by type from May 15th through November 15th, and to deal with the pre...

Last week I did an interview with the guys at DerivAlert about where we've come and where we're going. The result was a pretty concise overview of our thoughts on SEFs, US Treasury's, corporate bonds and European regulatory reform, so we thought it...

Spot FX trading volumes in the first quarter of 2014 dropped 25-30% from the same period last year. From a macro-economic perspective, the reasons are relatively clear. In 2013, FX trading volumes were inflated by a surge of activity in the first...

The biggest finding in our latest report (available to market structure and technology customers) on FX electronic trading was nothing. Our 1500+ interviews with global FX users showed continued growth in electronic trading (74% of users trade FX on...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder