If you work in institutional finance you’ve heard talk of market structure. Not only are there entire conferences dedicated to the topic, but most of the participants at those conferences— banks, asset managers, researchers—send their heads of...

If you work in institutional finance you’ve heard talk of market structure. Not only are there entire conferences dedicated to the topic, but most of the participants at those conferences— banks, asset managers, researchers—send their heads of...

Capital is expensive and getting more expensive. But the problem is proving a much harder one to manage in Europe, with European banks continuing to deleverage and already complying with the principles of Basel III while US banks have their capital...

Turned out the first week of mandatory SEF trading was a Big Bang, just in the wrong direction. Reported SEF volumes for interest rate swaps fell off a cliff for the week of February 17th, cliff signdropping 64% (revised down slightly as new data...

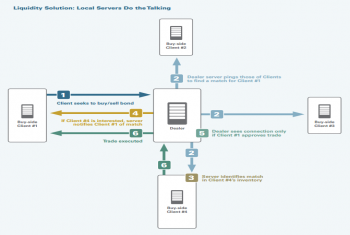

We all know that the massive reduction in dealer inventories and the cost of capital has had a huge negative impact on liquidity in the corporate bond market. While the primary market has helped soften the blow, that crutch...

Tuesday February 18th is certainly a big deal. Requiring swaps to trade on registered platforms was one of the primary tenets of derivatives reform since shortly after the Lehman big bang theory bankruptcy, and finally the day has arrived. This is...

We spoke to just under 500 portfolio managers and traders globally to see what they’re doing with and what they think about OMSs, trading-system EMSs and TCA platforms for Equities, FX and Fixed Income. This is not a space of dramatic year on year...

Its true. If you step back and think about it for a minute, the work carried out over the past four years to create an electronic swaps metia-logomarket almost from scratch is pretty amazing. PR Metia just released their FinTech Insight 2014 report...

Its been my experience that many in the market are ignoring FX in the global derivatives reform debate, thinking of them as broadly exempt from new rules. This view is a bit of a red herring. Our latest research report digs into the regulations set...

The CFTC is great at sending emails out at inopportune times. In this case it was the 13 no-action letters sent between December 20th chicagoand December 31th while most of the financial world was trying to take a deep breath and enjoy some time off...

The year 2013 will likely go down as the year of mandatory clearing. Once ignored by eager financial market Greenwich Associatesprofessionals as boring back-office stuff, collateral management, credit limits and all other things clearing stood front...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder