Call them what you will – non-bank liquidity providers, principal trading firms, high frequency traders, electronic market makers – but this not-so-new-anymore breed of market participants is increasingly important to market liquidity,...

Call them what you will – non-bank liquidity providers, principal trading firms, high frequency traders, electronic market makers – but this not-so-new-anymore breed of market participants is increasingly important to market liquidity,...

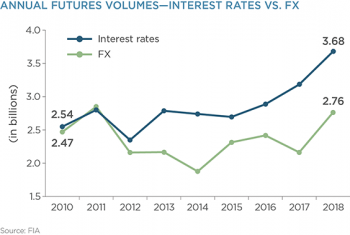

Given recent changes, FX futures and similar instruments have the potential to grow fast enough that FX may eventuially follow int he footsteps of U.S. Treasuries...

With Bitcoin topping $11,000 this weekend for the first time since March 2018, the crypto winter is definitely over. The same cannot be said for enterprise blockchain initiatives.

The RFQ market for U.S. Treasuries, pioneered by Tradeweb in 1999, helped traders of the time make the leap onto the screen by making their current workflow more efficient while still knowing their clients. RFQ trading has evolved to allow further...

Following recommendations from the SEC's Fixed Income Market Structure Committee (FIMSAC), FINRA is proposing a pilot program to test the impact of changing the reporting requirements for large corporate bond trade.

On any given day in the U.S. corporate bond market, roughly 70% of the trades executed are for 100 bonds or fewer (equivalent to $100,000 or less). Greenwich Associates data shows that the vast majority of these trades—over 90%—are now done on...

Rapid advances in data curation and technology are changing the measurements of success in the commercial payments business.

When you spend your days living in the world of market structure – as we do here at Greenwich Associates – it can seem as if change happens slowly. While everyone agrees that the current market structure is not perfect, changing it can be difficult...

Volumes in the U.S. Treasury market are up in the first few months of 2019, and as Greenwich Associates data shows, so too is competition among the electronic trading venues. Kevin McPartland had the opportunity to speak with Jill...

The profusion of accessible data, and the advance of computing power and machine learning, have transformed TCA from a check the box exercise meant to satisfy the regulators to something else. TCA has reached a level where it can see beyond the...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder