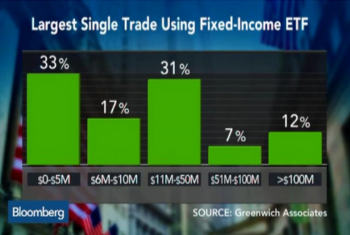

We recently published new research examining the use of Fixed Income ETFs by institutional investors.

We recently published new research examining the use of Fixed Income ETFs by institutional investors.

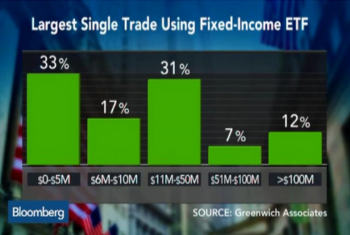

Excel is the biggest killer app of all time. Yeah, web browsers are pretty useful and Instagram was sold for $1 billion, but when it comes to managing numbers nothing can touch Excel. This is why global financial markets continue to be run by Excel...

A crisis is a crisis because most people didn't see it coming. Unexpected events freaks people out causing a bad chain of events - a crisis. So despite evidence that a liquidity crisis is on the horizon in the bond market, wide spread recognition...

Social media has become ubiquitous and in large part defines how we interact in a busy digital age. But not every platform is created equal, especially not for business and investing. We recently interviewed 256 institutional investors—pensions,...

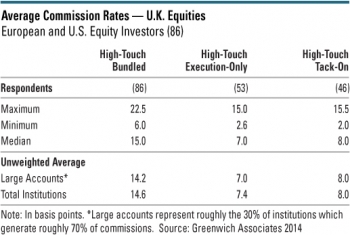

Our recent report, “Equity Trade Commissions: Rates Vary Broadly Across and Within Markets,” highlighted an interesting finding from a Greenwich Associates study: average bundled commission rates on equity trades are surprisingly consistent across...

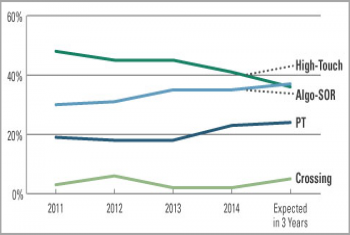

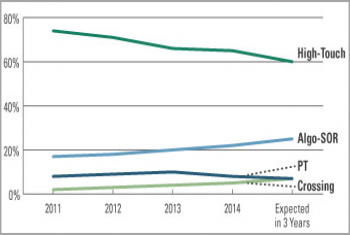

Larger institutions in Japan now execute only roughly 41% of trades as traditional single stock high-touch trades, well down from 48% in 2011.

Central bank policy shouldn't really be part of the market structure story. Market structure is about regulatory change, technology innovation and market reactions to the evolving competitive landscape.

Institutions in Asia are executing a steadily increasing proportion of business on a low-touch basis (algorithms, DMA, crossing, portfolio trades) as opposed to traditional high-touch business executed through a broker sales trader.

Our conversations with dealers over the past few months have left us wondering if volume weighted market share is the right metric for gauging success in fixed income dealing. In past years market share always brought with it bragging rights, both...

The market has been talking about this since at least 2009: swaps clearing will reduce systemic risk and take most of the counterparty risk out of the swaps market. Yet despite this risk reduction, regulators still seem determined to make the...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder