Are you wondering if the growth of corporate bond electronic trading in the past decade limits its growth in the next 10 years.

Are you wondering if the growth of corporate bond electronic trading in the past decade limits its growth in the next 10 years.

March 2020 was the highest volume month in the history of the U.S. Treasury market with the average daily notional volume (ADNV) hitting $944 billion.

Review key industry trends for the institutional investors market in Canada.

Review key industry trends for the institutional investors market in the United States.

Compare salary and bonus versus those of peers by similar tenure and job function.

European investors continue to demonstrate a more entrenched commitment to sustainable practices— nearly all European investors reported that ESG is currently employed in their portfolio. Hot on their heels are Asian investors, with 86% stating that...

Information is constantly competing for attention, and attention is a scarce commodity. As we receive an increasing amount of information, our available attention to consume that information decreases.

Repo and U.S. Treasury clearing will increase in 2026. The SEC finally put forth, voted on and passed a final rule laying out their long-expected approach to mandatory clearing for this systemically important market after years of industry...

Join Kevin McPartland as he moderates a panel to discuss the current state and size of portfolio trading in U.S. corporate bonds, new ways in which portfolio trading can improve execution outcomes, and portfolio trading’s future state – new asset...

CME Group, Global Head of Financial & OTC Products, Tim McCourt recently sat down with Head of Market Structure & Technology Research at Coalition Greenwich, Kevin McPartland, to discuss insights on financial & OTC products covering...

Tradeweb CEO Billy Hult recently sat down with Head of Market Structure & Technology Research at Coalition Greenwich Kevin McPartland to discuss the evolution of electronic trading in the fixed-income market, his time as CEO and growth...

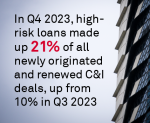

New data on bank lending shows just how tenuous the situation is for companies and the economy as a whole as the world waits to see whether the U.S. Federal Reserve will cut interest rates in 2024.

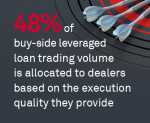

After a notable drop in leveraged loan revenue in 2022, dealers saw a rebound in 2023 with U.S. revenue topping $900 million. That total represents a 16% increase from 2021 and a 29% jump from 2022, according to a new study from Coalition Greenwich...

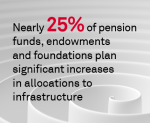

Traditional asset managers could face an increasingly challenging marketplace in Japan as asset owners slow expectations for manager hiring and shift allocations in the direction of alternative and private assets.

Peter Lacerenza oversees the development and execution of overall marketing strategies for institutional investors and corporate and commercial banking clients globally. In addition, he supports the Firm's relationships with key decision-makers...

Chris McDonnell advises senior management at leading commercial, corporate and investment banks and has nearly 15 years of industry experience consulting with senior executives on key strategic, competitive and market challenges. Prior to...

Kevin McPartland is the head of market structure and technology research. He has nearly 20 years of capital markets industry experience with deep expertise in market structure, regulation and technology impacting the fixed-income, FX and equity...