Investors continue to express frustration with credit market liquidity, but massive efforts undertaken by market participants and service providers are finally starting to ease the pain. Success has started to arrive via solutions that open up the pool of potential buyers and sellers, and platforms that mine data to create a view into the location of every bond in the world.

The former is a very logical step, with increased volumes on all-to-all platforms a tangible sign of progress. The latter is an even more complicated undertaking and could arguably be more impactful over the long run. If Uber can upend the taxi business without owning any cars, it might be possible for a complete data set with the right intelligence to create a virtual balance sheet without having one of its own. As such, putting the two solutions together should take us a long way toward a more fluid secondary market.

This research examines changes in fixed-income investor behavior as it relates to market electronification and examines the market’s remaining incumbent and new technology solutions best placed to drive change going forward.

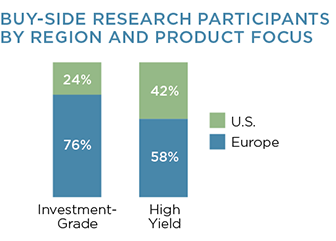

MethodologyBetween February and July 2016, Greenwich Associates interviewed 998 U.S. institutional investors and 1,132 European institutional investors active in fixed income. Interview topics included trading and research activities and preferences, product and dealer use, service provider evaluations, market trend analysis, and investor compensation.