We've just released the results of our benchmark US equities study, based on almost 600 interviews with US equity investors. While Greenwich has been conducting this study for literally decades, this is my first market structure analysis...

We've just released the results of our benchmark US equities study, based on almost 600 interviews with US equity investors. While Greenwich has been conducting this study for literally decades, this is my first market structure analysis...

Over the past decade or so, the growth of OMS and EMS platforms has paralleled the growth of electronic trading – but it would be a stretch to suggest a direct cause-and-effect relationship. These days, though, given the growing importance of...

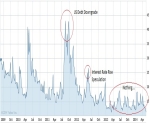

I'm a little obsessed with volatility lately - well, the lack of it actually. The VIX has been hovering around 12 for months despite emerging markets turmoil, rigging scandals and regulatory environment that can only be described as volatile....

If you work in institutional finance you’ve heard talk of market structure. Not only are there entire conferences dedicated to the topic, but most of the participants at those conferences— banks, asset managers, researchers—send their heads of...

Turned out the first week of mandatory SEF trading was a Big Bang, just in the wrong direction. Reported SEF volumes for interest rate swaps fell off a cliff for the week of February 17th, cliff signdropping 64% (revised down slightly as new data...

The year 2013 will likely go down as the year of mandatory clearing. Once ignored by eager financial market Greenwich Associatesprofessionals as boring back-office stuff, collateral management, credit limits and all other things clearing stood front...

In the past I’ve spoken about buy side incentives for using an agency model – chief among them the reluctance or inability to navigate the slew of legal documents an institutional investor would need to sign in order to gain access to the needed...

We are always here to help you