Eighty-six percent of buy-side equity investors in the U.S. use a third-party order management system (OMS). Of those, the OMS being used has been in place for an average of 10 years. These two statistics alone point to a fully mature market, one that has been evolving and growing for nearly 30 years.

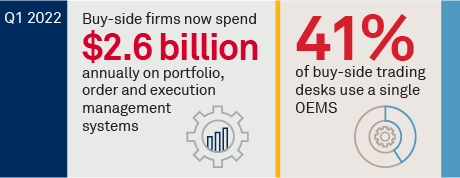

Coalition Greenwich data shows that buy-side firms now spend $2.6 billion annually on portfolio/order management systems, with the majority of that revenue generated by mid-tier asset managers with assets under management (AUM) ranging from $500 million to $25 billion. While the largest asset managers each spend considerably more annually than their smaller peers, the sheer number of firms in that asset range creates the largest opportunity for trading system providers. In addition to the tireless work put into enhancing existing features, improving data quality and addressing user concerns, the two biggest trends for OMSs continue to be the search for the perfect combined order/execution management systems (OEMS) and the move to the cloud.

MethodologyThis study is based on interviews with 49 U.S.-based equity traders and portfolio managers in Q4 2021. Respondents were primarily from asset managers, and topics discussed included platform usage, likes and dislikes, technology spending, and emerging trends.