Table of Contents

Investment in “wealthtech,” or digital solutions that facilitate wealth management processes, hit record levels in 2021. Demand has been driven by a number of major acquisitions emblematic of what could be described as an industry renaissance. Morgan Stanley bought Eaton Vance, including the Parametric business. Franklin Templeton acquired O’Shaughnessy Asset Management, including its Canvas technology. And most recently, UBS bought robo-advisor Wealthfront in hopes of attracting more Gen Z investors.

On the surface, these technology-first acquisitions, coupled with the pandemic-fueled DIY investing trend, suggest the value of financial advisors (FAs) is waning. But we don’t see it that way and neither do the advisors themselves. Coalition Greenwich research in Q4 2021 found that three-quarters of investors in the U.S. with $100,000 or more in investible assets work with an FA, helping maintain the number of advisors in the U.S. steady at roughly 330,000. In fact, the population-to-advisor ratio in the U.S. remains the world’s highest by far.

Don’t Get Emotional About Stock

Over two-thirds of the 669 financial advisors in our study expect that the DIY investing trend, which accelerated during the COVID-19 lockdown of 2020, will either have no impact or, conversely, generate more demand for financial advice over time. Although robo-advisory software and portfolio construction tools can suggest asset allocations, for those who do not work full time in the financial markets, deciphering what the robots suggest can be complicated, scary and, in some cases, emotionally draining. Hence the need for FAs.

So Many Choices

Technology has made investing more accessible to more people than ever before, which is a good thing. But the breadth and depth of investment choices available to individual investors have also created a market structure that is increasingly complex. While we won’t debate whether the 60/40 portfolio is dead, we would contend that a portfolio consisting of only large-cap equities and highly rated bonds has, in fact, died.

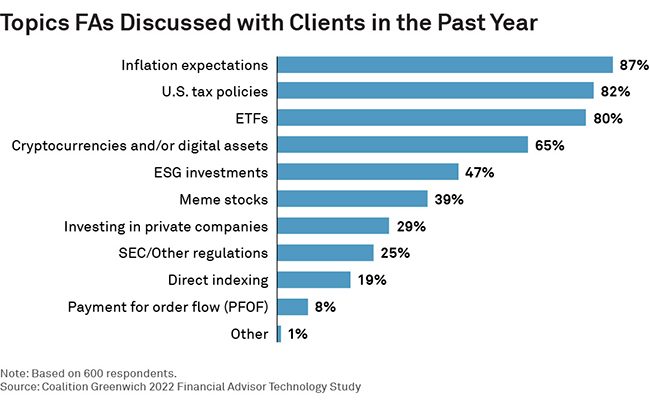

This idea is reflected in the views of the FAs participating in our study. Given that the study was conducted in January 2022, it is not surprising that discussions with clients focused most frequently on inflation and U.S. tax policies. Running close behind, nearly two-thirds of FAs discussed digital assets with their clients, while nearly half discussed ESG investments and a third private company investments.

Inflation in 2022 is real, and with it comes a search for yield. Despite rising government bond yields, rates are still near historic lows, and equity market volatility has most convinced that the stock market will not perform as favorably in 2022 as it has the past three years. These and similar factors are all driving appreciation of alternative investments.

What Regulations?

Interestingly, retail investors are not as concerned about SEC regulations and payment for order flow (PFOF), the practice that allows commission-free trading, which is a very different narrative from the one in institutional markets. Considerable debate continues in Washington and on Wall Street regarding the benefits that PFOF may or may not bring to retail investors. But as we’ve said in numerous other reports, PFOF brings with it commission-free trading and, from the retail investor’s perspective, they’ve never had it better.

Institutional Technology

Speaking of institutional markets, FAs increasingly feel that their technology is putting them on a more level playing field with institutional traders and investors. Twenty years ago, when calling a broker to place a trade and paying $50 commission per order was common, Wall Street was already trading with algorithms and executing in milliseconds. Now almost threequarters of advisors feel their technology is keeping up—albeit barely, according to more than half of respondents.

As mentioned earlier, this shift is largely due to huge investments in the sector. Founders see an opportunity to democratize market access, while venture capitalists see an opportunity to profit from the democratization. Ultimately, both FAs and retail investors win, as technology firms compete with one another on innovation and for eyeballs, while FAs increasingly compete based on their digital offerings as much as their track record.

Kevin McPartland is the Head of Research for Market Structure and Technology at the Firm

In January 2022, Coalition Greenwich gathered responses from 669 financial advisors in the United States, with the majority targeting high-net-worth and mass affluent clients. Topics included technology usage, client interactions and views on new investment vehicles.