Table of Contents

The global pandemic is putting economies and financial systems around the world under unprecedented stress. In India, this represents an even sterner test for a banking system that is still reeling from the impact of bank failures prior to the outbreak of COVID-19. Amid a national lockdown and fears of a liquidity crisis, companies in India are joining consumers in shifting business to the largest and presumably safest banks. In this report, we will analyze how the still-unfolding crisis and the many other challenges facing India’s banking sector are affecting the competitive positioning of individual public- and private-sector banks.

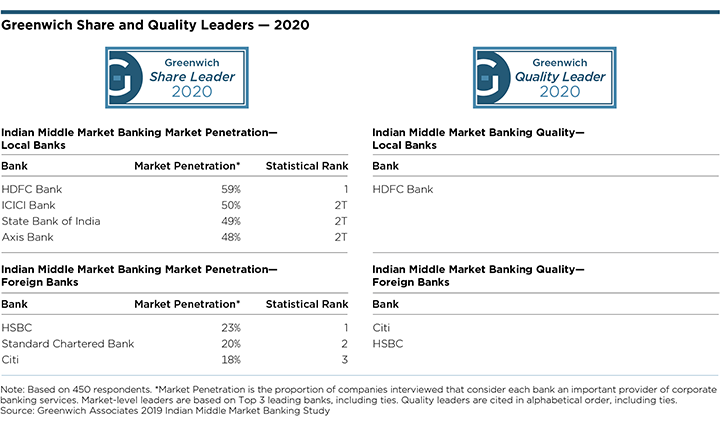

Consequences of the Crisis

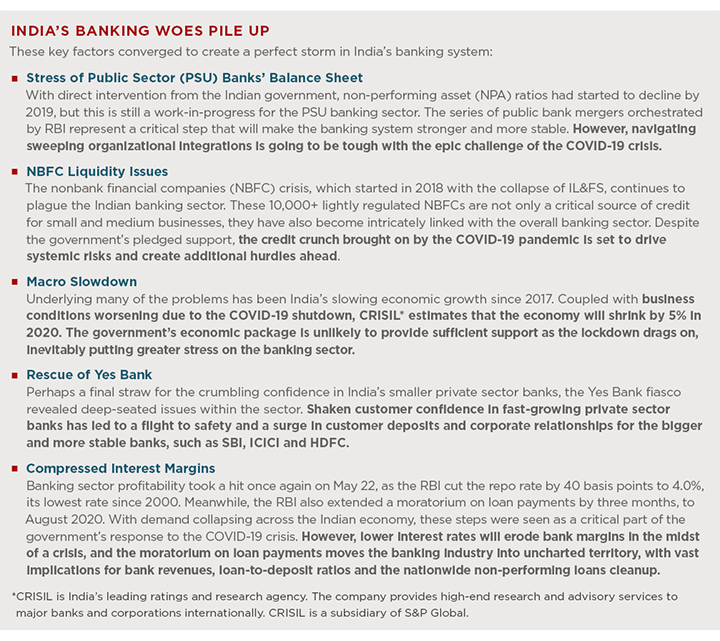

Even before the government instituted its COVID-19 lockdown, Indian companies were concerned about deteriorating economic conditions and worried about access to liquidity. The corporate treasurers participating in the Greenwich Associates 2019 Asian Large Corporate Banking and Indian Middle Market Banking Studies ranked liquidity management as their top priority for the year ahead, with funding and financing close behind. (Interviews were conducted from 4Q 2019 through 1Q 2020.)

“We are focusing on dealing with the current economic headwinds,” explained one corporate treasurer. “There is negativity, a lack of trust, and we struggle to get the credit limit that we usually do. We want to limit our dependency on banks and look into other sources such as equity. Lastly, we will want to ensure that we can maintain adequate liquidity to service our loans.”

At the time of our interviews, 41% of study participants ranked cost reductions as a top priority for 2020. That share is undoubtedly higher today. Weaker companies are already finding it more difficult to access credit, and as the economic consequences of the COVID-19 shutdown continue unfolding, Indian companies will come under even more pressure and will look to increasingly drastic measures.

Crisis Altering the Competitive Landscape: Safety in Size

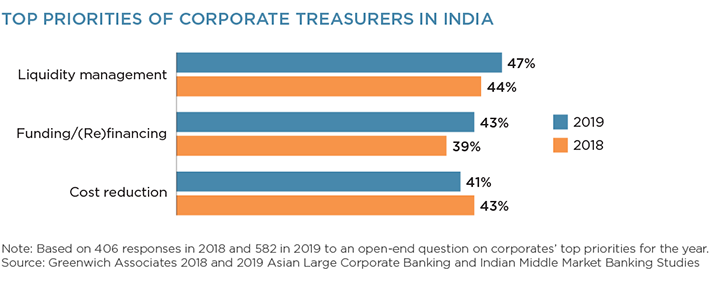

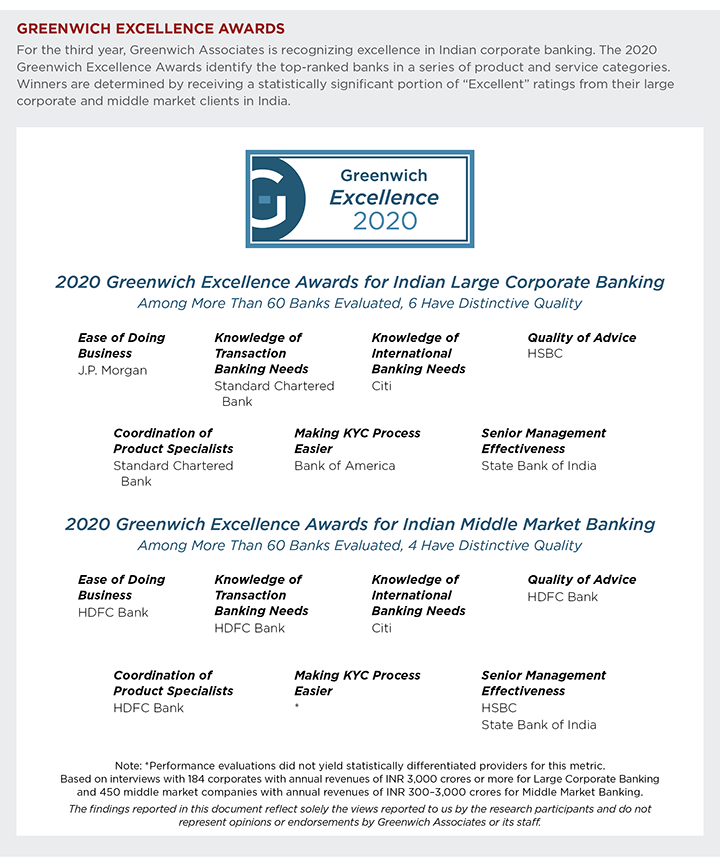

With COVID-19 arriving on the heels of a series of crises that already had India’s companies and consumers worried about the solvency of their banks, customers are flocking to the relative security of the country’s largest and presumably most stable banks. Many of those banks rank among the list of 2020 Greenwich Share and Quality Leaders.

Public Sector Banks

At the top of the list of India’s biggest and presumably most stable banks is State Bank of India, which might be in the strongest position to weather the crisis and even gain ground during this period of disruption. SBI is viewed as a safe haven in the midst of heightened bank risks triggered by the Yes Bank collapse and the resulting crisis of confidence in smaller private sector banks. Even more than before, the bank is now well positioned to leverage its stronger balance sheet and lower costs of funding to woo companies hungry for liquidity. However, this should not take away from the fact that SBI has laid a strong foundation for itself, with continued effort to improve clients’ perception of the bank’s capabilities and service quality.

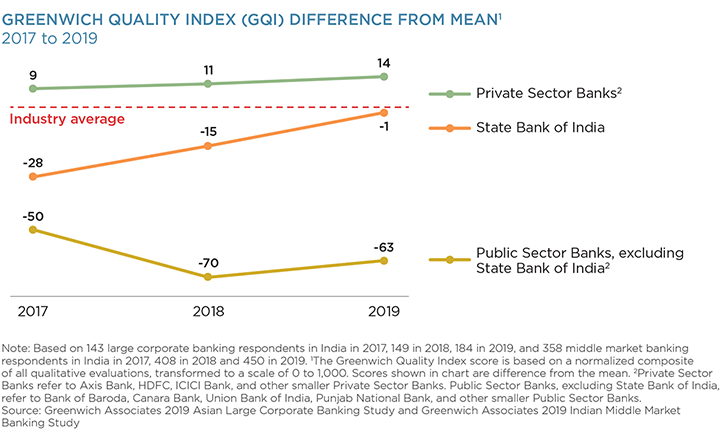

As shown in the chart above, SBI’s scores on the Greenwich Quality Index—a composite measure of bank quality based on ratings provided by corporate clients—have been on a steady climb since 2017, driven in large part by improvements in higher-level relationship factors like advisory capabilities. Although SBI still lags private sector players in these measures, these quality improvements make the bank an increasingly viable alternative for clients concerned about the safety of smaller private sector banks. At the same time, improved quality will put SBI in a strong position to win new business from other public sector banks that experience service disruptions from either merger integrations or the COVID-19 crisis. Across the board, any new corporate relationships will be particularly valuable to SBI. The reason: When SBI assumes the role of a company’s lead domestic bank, it tends to crowd out rivals and capture an outsized share of the company’s overall wallet.

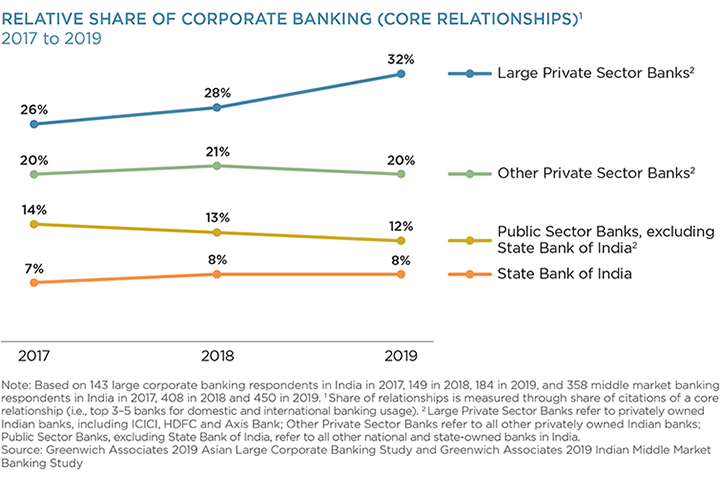

It is unclear how smaller public sector banks will fare during the crisis. Excluding SBI, public sector banks have been gradually losing share of core corporate banking relationships, declining from 14% in 2017 to 12% in 2019. In terms of quality ratings from Indian companies, these banks lag private sector players by a wide margin and have been virtually left behind since 2017, as SBI steadily improved. Now, as the Indian government merges public sector banks, they face challenging integrations. Together, these factors suggest that public sector banks other than SBI could be at risk of losing additional corporate relationships and market share during the crisis—even as the government’s restructuring of the sector sets them on a trajectory to emerge as stronger organizations and more capable competitors in the long term.

Private Sector Banks

Even before the COVID-19 crisis, India’s biggest private sector banks were winning business from their smaller private-sector counterparts, due in large part to fallout from the Yes Bank restructuring. In 2018, private sector banks accounted for 49% of core corporate banking relationships1 in India. That total was divided between 28% held by the three largest private sector banks, ICICI, HDFC and Axis Bank, and 21% held by other, smaller private sector competitors. From 2018 to 2019, this group of smaller private banks lost a percentage point of penetration, while the three largest private sector banks added four percentage points, climbing to 32% of the total.

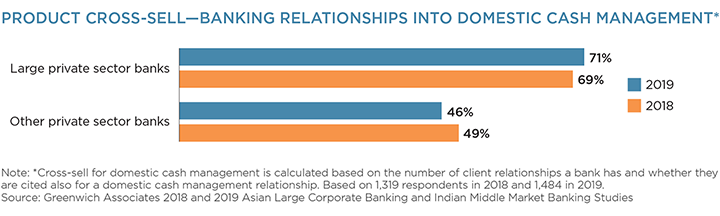

Weakness for smaller private sector banks was also visible in their ability to hold on to domestic cash management relationships. The proportion of smaller private sector banks’ clients using them for domestic cash management needs dropped to 46% in 2019 from 49% in 2018. As one corporate treasurer explained about his company’s decision to limit its use of a smaller private bank, “We can’t leave deposits/TRA with them. There is an absence of stability.”

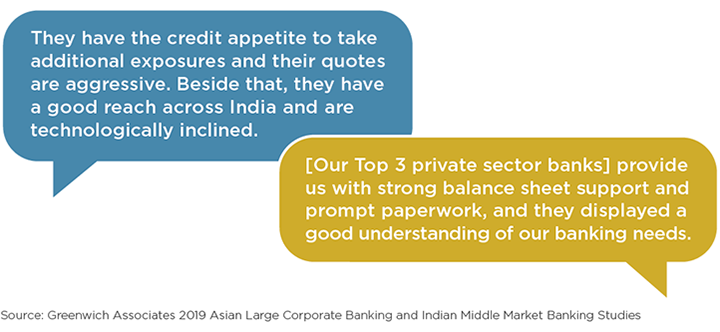

We expect this trend to continue through the pandemic lockdown. Coming into the crisis, Indian companies viewed ICICI, HDFC and Axis Bank as offering the market’s highest levels of quality and service:

Large private sector banks also excel in helping clients in the digitization of their banking process—an important strength as the demand for digital banking spiked in the midst of the pandemic. Look out for an upcoming Greenwich Report on the latest banking digitization trends in India.

Liquidity Crisis or Solvency Crisis?

As of now, the government moratorium on loan payments is acting as life support for companies, many of which simply don’t have the cash flow needed to make payments in the economic lockdown, and for banks, some or even many of which could already be veering toward insolvency without the measure. But the moratorium is not a restructuring. Eventually, companies will have to return to paying interest and principal, and banks will have to account for these loans.

The central bank is undoubtedly hard at work trying to ease this transition, but in the next few months, the stressed balance sheets of India’s banks could be put to an unprecedented test. In the end, the fate of the Indian banking industry during COVID-19 will come down to one question: Does the crisis remain what it is today—a liquidity crisis caused by the sudden interruption of economic activity—or does it metastasize into a much more dangerous solvency crisis that would require a much larger intervention?

Greenwich Associates Head of Asia, Gaurav Arora, and consultant Winston Jin, specialize in Asian corporate/transaction banking and treasury services.

1Core relationships are defined as the top 3-5 banking relationships where the corporate’s majority share of wallet is concentrated.

MethodologyFrom September 2019 to March 2020, Greenwich Associates conducted interviews with 184 Large Corporates and 450 middle market businesses in India and asked them to name the banks they use for a variety of services, including corporate lending, cash management, trade services and finance, foreign exchange, structured finance, interest-rate derivatives, and investment banking.

The Greenwich Quality Index (“GQI”) comprises metrics which measure Institutional Relationship Quality and Overall Coverage (i.e., “People”) Quality. Institutional Relationship Quality factors include “Effective Senior Management Support,” “Ease of Doing Business,” “Willingness to Lend,” “Most Competitive Pricing,” and “Ability to Communicate Upfront on KYC Requirements.” Coverage Quality factors include “RM’s Proactive Provision of Advice,” “Knowledge of Transaction Banking Needs,” “Knowledge of International Needs,” “Frequency of Visits,” “Timely Follow Up on Requests,” and “Effective Coordination of Product Specialists.” Study participants were then asked to rate their banks in 14 product and service categories. From September to November of 2019, Greenwich Associates conducted 184 interviews in large corporate banking with companies in India. Subjects covered included product demand, quality of coverage and capabilities in specific product areas.