Envisioning technology that doesn’t exist today and its application within financial markets is nearly as hard as predicting the market itself.

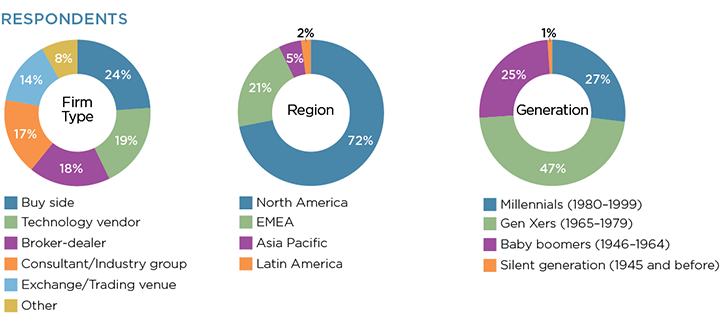

In this Greenwich Report, the first of a three part series made possible by Refinitiv, we’ll examine the forces and technology driving the trading desk of the future from the vantage point of 107 capital markets professionals that participated in this research.

Topics include what tools and technologies will have the biggest impact on financial markets, the use of AI, big data deployment, and the impact (or lack thereof) of cryptocurrencies.

We’ll also examine the different mindsets of those working within the capital markets, both by firm type and generation. While technology was broadly seen as a positive for financial markets, views on specific technologies and personal job prospects differed in interesting ways based on the respondent’s age and employer.

Ultimately, our research findings confirmed that the fintech revolution of the past decade is set to pick up even more steam in the coming years. With investors, banks, exchanges, and technology firms finally out of defensive mode following the great recession of 10 years ago, real investment in the next generation of fintech is now having a broader impact than ever before.

MethodologyIn April 2019, Greenwich Associates conducted an online study with 107 capital markets professionals globally. The study examined the technology trends, the data explosion and the skills required to be successful in capital markets in the future.