The competition among FX trading protocols and venues is both interesting and perplexing, given their diversity and the incredible choice they provide market participants.

FX market structure is unique, encompassing an array of venue categories with breadth within them. There are single-dealer platforms (SDPs), multidealer platforms (MDPs), electronic communication networks (ECNs), application programming interfaces (APIs), and, most recently, API aggregators. Greenwich Associates research in 2018 focused on the competition between SDPs and MDPs, a competitive dynamic that continues today.

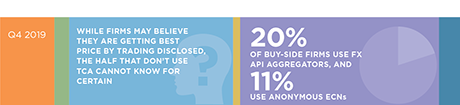

In this Greenwich Report, the first of our 2019 Market Structure and Trading Technology series, we focus on anonymous ECNs and why central limit order books (CLOBs) have not made greater headway against platforms that provide disclosed bilateral liquidity. We also examine the role that API aggregators play and why—even though they are not trading venues in and of themselves—they are an increasingly critical part of the FX electronic trading story. First, however, a broad review of the landscape is in order.

MethodologyThroughout June and July 2019, Greenwich Associates interviewed 97 FX investors globally as a part of our annual Market Structure and Trading Technology Study. Respondents were asked how they select an FX trading platform, how they determine quality execution, as well as the influences of selecting an FX algo.