Table of Contents

A community bank that provides access to live tellers via video from ATMs so that customers don’t have to leave their warm cars in winter. A regional bank named one of the best places to work in 2019 by the Chicago Tribune. A Nashville bank that delivers top-tier service to customers while also fighting for share in one of the country’s fastest-growing and most competitive markets. These are a few of the 2019 Greenwich CX Leaders in U.S. Commercial and Retail Banking.

Last year, Greenwich Associates debuted the CX Leaders Awards. It was launched to reflect the growing importance of CX (customer experience) programs in the U.S. banking industry as well as the more general, near-universal shift among banks to more customer-centric business strategies.

The Greenwich CX Leaders in U.S. Commercial Small Business, Middle Market Banking and U.S. Retail Banking are banks that must achieve scores that exceed the industry benchmark by a specified margin in three categories:

- Overall satisfaction

- Likelihood to recommend

- Likelihood to continue using/switch providers

These scores are derived from interviews with key corporate decision-makers at nearly 24,000 companies and more than 11,000 retail customers. Any bank that submits CX data to Greenwich Associates is eligible for the CX Leader designation.

The Best of CX

The data from our 2019 research shows that companies and individuals need to be careful. Virtually all banks today are touting a new commitment to customer service. But is it lip service or is it real?

There are two easy ways to tell:

Executive Sponsorship: Is the bank’s senior leadership team actively and publicly engaged in the CX effort? At many of the 2019 Greenwich CX Leaders, the CEO is in the room leading the charge. These banks understand that it takes this level of executive sponsorship to break down the silos that undermine the customer experience. “If you don’t see faces from the C-suite involved in CX, be skeptical,” says Ron Balmer, Greenwich Associates Managing Director, Customer Experience.

Digital Integration: You can’t deliver state-of-the art customer service in 2019 without robust digital capabilities. But digital alone won’t deliver a good customer experience. On the contrary, some banks are implementing digital tools simply as a way to reduce cost-to-service. “In virtually every bank with best-in-class CX, we find seamless integration of digital capabilities that enhance—rather than replace—the human interaction with a banker or relationship manager,” says Jacqueline Vose, Greenwich Associates Managing Director, Customer Experience.

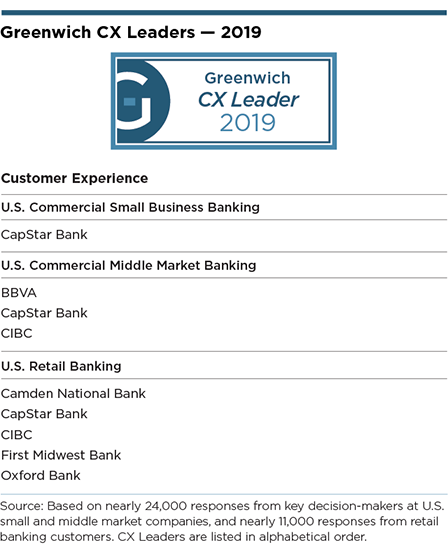

2019 Greenwich CX Leaders

U.S. Commercial Small Business Banking: CapStar Bank

CapStar Bank. Nashville is on fire. Companies are relocating there. The population is booming. This fast-growing economy has produced one of the country’s most competitive banking markets. In this environment, CapStar Bank is betting on CX as its competitive advantage. Few institutions of this size have an executive Chief Culture Officer. Even fewer place so much value on CX that their Customer Services Leadership Team is listed beside executive leadership and the board of directors on their home pages. This commitment has enabled CapStar to carry over its excellence in customer service from its original commercial banking business into retail banking and wealth management.

U.S. Commercial Middle Market Banking: BBVA, CapStar Bank and CIBC

BBVA. BBVA has closed the loop. That’s what we call it at Greenwich Associates when a bank succeeds in building and implementing a CX program that both identifies issues and provides a mechanism for consistently correcting problems. BBVA’s management reviews CX data down to the individual customer level, empowering (and requiring) individual relationship managers to “own” the response to feedback from their customers. This granular attention to CX detail has enabled the Bank to maintain and even increase customer loyalty among its primarily Southeastern U.S. customer base during the potentially disruptive rollout of a new treasury management system that will ultimately further enhance the customer experience.

CIBC. CIBC’s leadership team is a who’s who of Chicago banking. That level of experience is paying off: In one of the toughest banking markets in the U.S., CIBC manages to stand out. It does so mainly by delivering customer service that is not only above average, but is frequently best in class. What’s perhaps most impressive is that CIBC has been able to maintain this level of quality through the integration of its $5 billion 2017 acquisition of Chicago’s PrivateBank.

U.S. Retail Banking: Camden National Bank, CapStar Bank, CIBC, First Midwest Bank, and Oxford Bank

Camden National Bank. There was only one repeat CX Leader in 2018 and 2019, and that’s Camden National Bank. This consistency is due largely to the fact that its CX program was launched and championed by President and CEO Greg Dufour. Under his leadership, the Maine-based Bank has dismantled internal silos, integrated smart digital technology and focused the entire strategy around delivering an optimal community bank experience.

First Midwest Bank. First Midwest is on a roll. Earlier this year, it was named a 2019 “Top Workplace” by the Chicago Tribune. Now it’s a 2019 Greenwich CX Leader. A main reason for this success: First Midwest is one of the few banks of its size to deploy a comprehensive CX program. This commitment to CX has enabled the Bank to maintain its industry-leading standards of service while acquiring two banks and expanding into Milwaukee and Iowa.

Oxford Bank. Oxford Bank knows its customers—and it knows they are cold. That’s why the Bank installed video monitors in its ATMs that allow customers to talk to tellers without ever leaving their cars in frigid Michigan winters. Oxford also knows that its customers—like all retail banking customers—sometimes struggle to figure out how to use online and mobile banking tools. So the Bank regularly sits down with customers in its branches and teaches them how to use new features like mobile check deposit. These are just two examples of how Oxford acts on feedback collected through its CX program to take specific action and improve the customer experience.

Managing Directors Ron Balmer and Jacqueline Vose provide clients with customer experience management optimization solutions.

MethodologyAwards are given to banks whose performance on an index of questions commonly included in Customer Experience programs exceeds an industry benchmark by more than a specified margin.

The Commercial Small Business and Middle Market Banking Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Likelihood to continue using

The Commercial Small Business and Middle Market Banking benchmark is based on a rolling four quarters of the Greenwich Associates Commercial Banking Study, which includes interviews with key corporate decision-makers at nearly 24,000 companies. Greenwich CX Leaders are determined at a national level.

The Retail Banking Awards are based on an index comprising the following questions:

- Overall satisfaction

- Likelihood to recommend

- Likelihood to switch—where Greenwich Associates CX derives likelihood to continue using

The Retail Banking benchmark is based on the Greenwich Associates 2018 Retail Banking Study covering nearly 11,000 retail banking customers.

Award thresholds for both Commercial and Middle Market Banking and for Retail Banking have been set to be challenging but attainable. However, because CX clients are compared to a benchmark that represents the entire market, not just the CX clients, it is possible for all CX clients to win awards or for no CX clients to win awards.

Index calculation details: The Commercial Small Business and Middle Market index is calculated as the mean of the three questionnaire items listed above and the Retail Banking Index as the mean of the three questionnaire items listed above. Scores originally measured on a 5-point scale are adjusted linearly to a 0-100 scale. The adjustment is as follows: (mean -1) * 25. In the case of questions that use 10-point scales, ratings are adjusted to 5-point scales using probabilistic assignments based on Greenwich Associates research.