Corporate bond markets have shown their excitement for portfolio trading over the past year, as volumes increased on an absolute and relative basis compared with the overall market. While the trading mechanism still represents just 3–5% of the total market, it appears to be one of the rare innovations that is equally fascinating to both the dealer and buy-side community.

Investors appreciate portfolio trading for its ability to provide price improvement, particularly on more thinly traded names, and as a time-saver when compared to trading all of the bonds in the portfolio individually. The sell side likes portfolio trading because it allows for diversification of risk with a broader basket of bonds.

One could argue that its presence in the market was both a cause and effect of new nonbank liquidity providers entering the space, and a major driver behind the big technology push of the top bank dealers to provide quicker and tighter prices to their clients.

Portfolio trading, of course, isn’t for every firm and every trade all the time. But there is a case to be made that, in many situations, portfolio trading offers price improvement for a wider array of market participants than are utilizing it today. In this report, we bring together feedback received from major market participants and a quantitative analysis of portfolio trade executions to explain portfolio trading, when it works, when it does not, and what to expect from this innovation going forward.

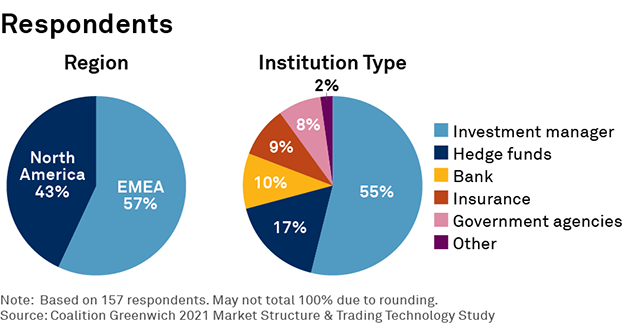

MethodologyThis research is based on conversations held during the second quarter of 2021 with banks, market makers, asset managers, hedge funds, and trading venues currently engaged in portfolio trading. The analysis also includes data from our annual Market Structure & Trading Technology Study, conducted in the fourth quarter of 2020, that includes responses from 157 global fixed-income investors. Data from FINRA, Tradeweb, Bloomberg, and ICE were also used to size the market and examine execution quality throughout 2020.