Table of Contents

The curve of new infections and new deaths from COVID-19 is flattening almost everywhere. The number of active cases is also starting to decrease in numerous countries, resulting in tentative steps to ease the lockdown measures in many places.

However, the economic impact of the crisis is revealing itself gradually with many surprises along the way—as illustrated by the historic first of West Texas Intermediate oil prices for May delivery shortly going into negative territory last week.

For institutional investors this means that they need to stay on their toes with regard to the impact of COVID on their investment portfolios. They have access to a huge flood of investment information and analysis, but cannot possibly consume and make sense of it all. A key question for both investors and the asset managers and consultants that serve them is to decide what they focus on.

Investors Supplement Key Information Sources with Specialist Resources

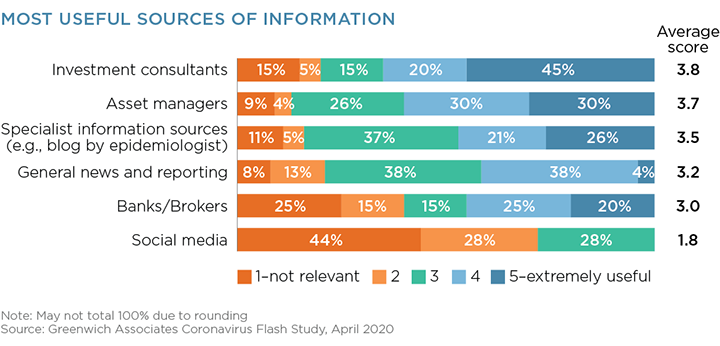

Historically, investors have mostly relied on investment consultants and asset managers for insight and advice to guide them through both “normal times” as well as through crises. However, there is no playbook for the current crisis. The globally synchronized nature of the crisis, coupled with governments trying to actively suppress GDP (via lockdown measures), is something investors have never experienced before.

It might make sense that investors would then go beyond their trusted sources of advice and insights, but the asset management industry on the whole has done a very good job of guiding its clients through this crisis.

In a recent flash study of institutional investors, investment consultants and asset managers are still considered the most useful sources of information during this crisis, unsurprisingly followed by specialist information sources, such as epidemiologists and key fact-gathering websites like John Hopkin’s COVID map.

Clearly, the fact that investment consultants and asset managers were well-established sources of information and analyses prior to the crisis has helped: Three-quarters of investors said the fact that they already knew the information source was a key reason for their turning to it during the crisis.

Lockdowns Accelerate Changes in Information Consumption Habits

While investment consultants and asset managers can take comfort in knowing they are generally the most relevant source of information, the individual firm will have to determine how to ensure that investors prefer its information over competitors’.

Quality of content is undoubtedly a key contributor, but the lockdown is accelerating changes in information consumption habits that provide several key takeaways on content delivery:

First, investors want to consume information on their own time. The ability to consume a piece of information in their own time is cited by three-quarters of investors as a key reason for turning to it.

This pattern favors content delivered via email, websites and webinars (which are usually recorded and can be watched later on) over individual phone or video calls and chat. In their conversations with Greenwich Associates, many asset managers have reported record attendance to their webinars hosted in the past few weeks.

Second, investors will spend varying lengths of time to read, watch or listen to content. This requires a much more subtle understanding of investor preferences, as they are often not very homogenous in this regard. Some investors may prefer a five minute read and others are happy to take 20 minutes to understand an important analysis.

For the asset manager and investment consultant, this may often mean creating and sharing both a more extensive analysis and a well-curated synopsis, with the latter often being the more resource-intensive piece of work, as nicely illustrated by the adage, “I did not have the time to write you a short letter.”

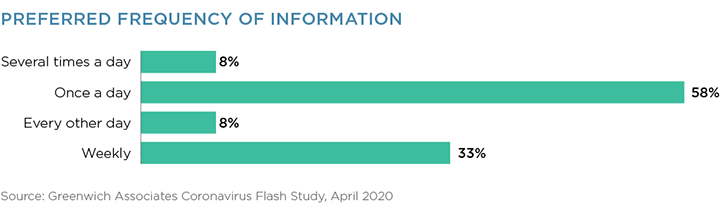

Third, know the preferred frequency of updates. Again, this is an area where investor preferences are not very homogenous, as illustrated in the following chart, which shows that some investors would like to receive updates on a daily basis and others on a weekly basis.

Knowing how often to provide updates to which investors requires an intimate understanding of clients. If clients don’t specify their preferred frequency, or if the option to select a frequency isn’t available, a mix of personal knowledge and data-driven analysis on the frequency of information consumption (such as open/click-thru rates matched to each communication sent) can be used.

Furthermore, asset managers also need to be cognizant of the link between investment strategies and frequency of updates. An investor investing into a private markets portfolio will likely want a much lower frequency of updates than an investor investing in liquid asset classes.