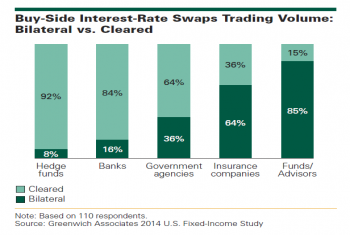

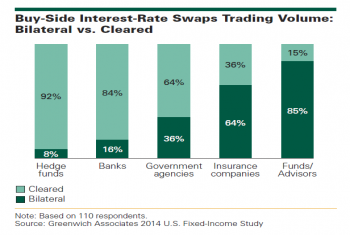

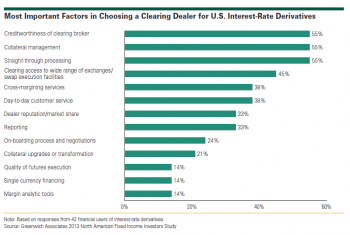

Although the U.S. swaps market has been radically transformed, market participants are still evaluating trading on swap execution facilities (SEFs) and how they may adapt their derivatives trading operations to comply with new regulation.

Although the U.S. swaps market has been radically transformed, market participants are still evaluating trading on swap execution facilities (SEFs) and how they may adapt their derivatives trading operations to comply with new regulation.

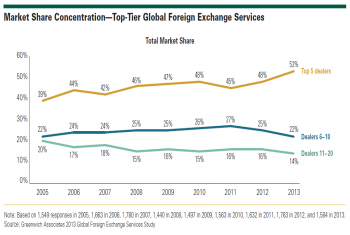

FX trading volumes are consolidating in the hands of the world’s biggest FX dealers.

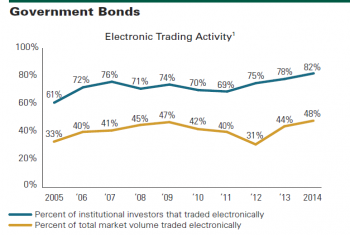

After bottoming out at 31% in the midst of the global financial crisis, the share of overall U.S. Treasury trading volume executed electronically climbed to 48% in 2014.

The evolution of the U.S. corporate bond market is underway, but the revolution is yet to come.

More institutions are looking at ETFs not just as tools for tactical portfolio adjustments, but as a means of efficiently implementing their broader investment strategies.

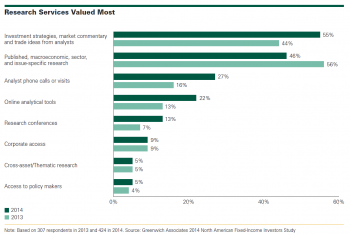

The percentage of clients rewarding dealers for fixed-income research doubled over the last two years and research in more illiquid products is even stronger.

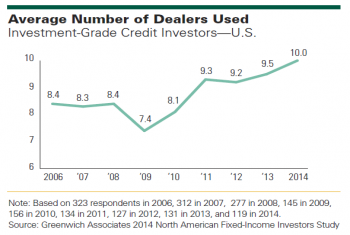

U.S. institutional investors concentrate even more of their rates-trading business with big banks.

Branding is emerging as a top priority for asset managers post-crisis, but when it comes to building a strong brand and differentiating themselves from competitors, asset management companies face specific challenges.

U.K. institutions investing in real estate debt may find better risk-adjusted value in whole or mezzanine loans.

For institutional financial services, a bottom-up index such as GQI provides a window into customer business allocations.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder