Return to Profits: Next Generation Structured Derivatives

New regulatory safeguards, coupled with an economic environment that is driving both supply and demand for structured derivatives, mean the OTC derivatives market is not going away.

New regulatory safeguards, coupled with an economic environment that is driving both supply and demand for structured derivatives, mean the OTC derivatives market is not going away.

As they pare back on their lists of brokers and providers, most institutions rely on the “broker vote” to determine which firms to keep, and ultimately, how their research and advisory service dollars will be apportioned.

U.K. consultants report strong demand for core real estate but think clients will be slow to move to value-added space.

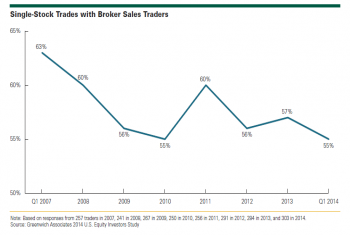

Armed with next generation technology, the sales trader of the future can provide clients with custom-feel service despite a challenging commission environment.

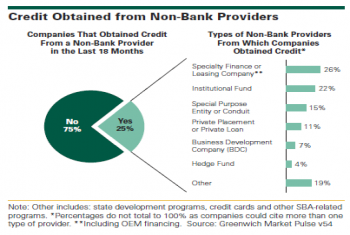

A notable share of U.S. small businesses and middle market companies are obtaining credit from non-bank providers.

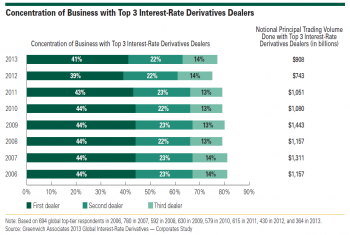

Corporate users continue to concentrate their IRD business among their top three dealers, while asset managers and hedge funds are starting to diversify their lists.

Investors’ desire for low-touch trading is tempered by content needs accessible only through high-touch channels.

Mid-tier brokers see strong gains as research source, now accounting for 40% of the research wallet.

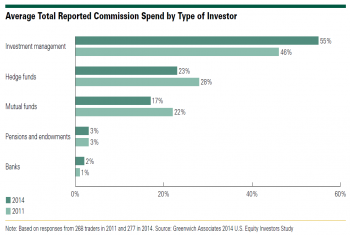

Despite lower market volumes, U.S. equity investors seeking content drive up the commission wallet.

Hedge funds could see IT costs slashed by using cloud computing on demand.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder