European Fixed Income: E-Trading Growth Continues

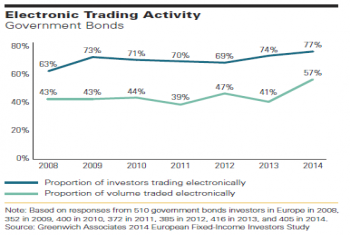

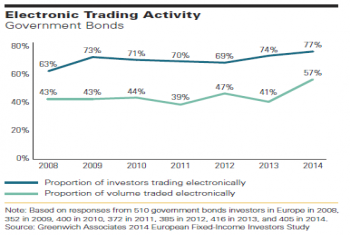

In European FI, the ongoing trend toward electronic markets mirrors a broader leadership in digital communication that outpaces the U.S. market.

In European FI, the ongoing trend toward electronic markets mirrors a broader leadership in digital communication that outpaces the U.S. market.

While many financial models are a key driver of profits on both the buy side and sell side, the oversight of those models and their use is a common complexity faced on the Street.

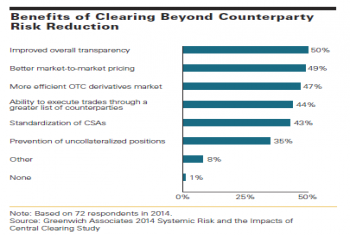

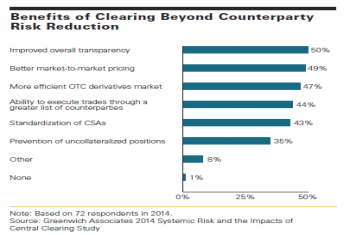

Central clearing of derivatives is leading the charge toward systemic risk reduction.

Over the medium and long term, futures products will gain traction at the expense of more standardized cleared swaps.

Fundamental changes in investor demand are making the “solutions” approach relevant to all asset managers—including both firms that will pursue solutions strategies as a means of growing their businesses and firms that will...

European asset managers are at the forefront of a move by institutional investors to integrate exchange-traded funds (ETFs) into their investment portfolios.

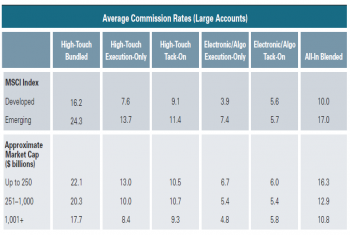

While commission rates on equity trades vary from country to country and from developed to emerging markets, new research reveals that commission rates vary from investor to investor within markets.

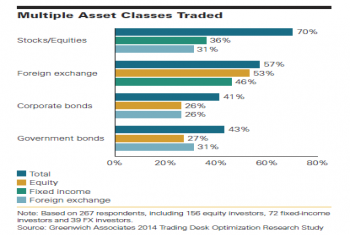

The concept of trading multiple asset classes through a single trading system is alluring, but traders' appetite for the systems shows a disconnect between the model and its practicality.

ETFs, a mainstay in European institutional equity portfolios, are quickly gaining traction in fixed income.

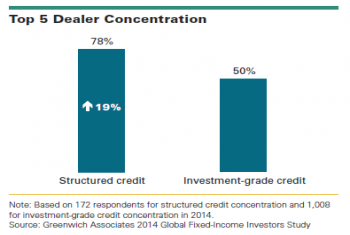

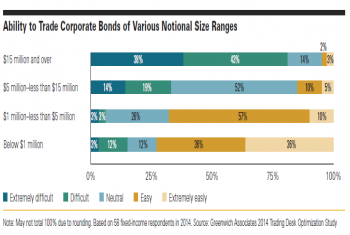

Relationships still matter when trading corporate bonds, but with dealers less willing and able to act as the market's shock absorber, the buy side is looking to new solutions.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder