Greenwich Commercial Lending Market Insight - Q2 2022

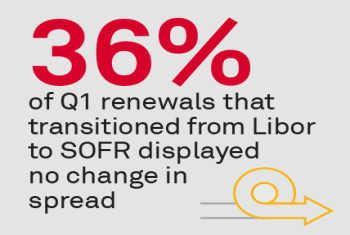

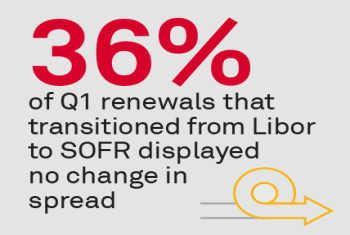

As Q2 2022 begins, most banks have moved away from originating new Libor-based loans.

As Q2 2022 begins, most banks have moved away from originating new Libor-based loans.

ESG has entered the investment mainstream. A fringe concept in the global investment community less than 10 years ago, environmental, social and governance policies are now widely adopted by asset owners and managers alike.

The search for yield and an abundance of fast-growing startups have left even mass-market investors clamoring for the opportunity to invest in private companies.

Banks of all sizes have an opportunity to strengthen client relationships in Asia by helping companies adopt and implement ESG driven practices.

FY21 Coalition Index Investment Banking revenues were up by 8% on a YoY basis.

Derivatives clearing has experienced a consistent growth trend for more than a decade. While buy-side adoption of clearing was originally driven by new regulations following the global financial crisis, the growth of clearing in the past few years...

U.S. Commercial Banking contributed steadily to the overall industry revenue pool up until FY19 but from the beginning of 2020 there has been a continuous decline in share.

Tokenization allows traditional capital markets participants to harness the benefits of blockchain technology—such as an immutable ledger of ownership, transaction history and rapid settlement.

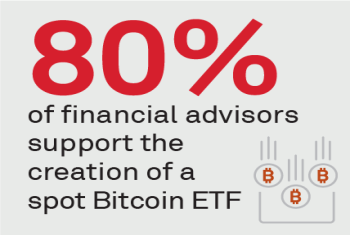

Recent Coalition Greenwich research found that two-thirds of financial advisors in the U.S. had discussed crypto and/or digital assets with their customers in the past year, but for the vast majority of advisors those discussions have not led to...

In late September 2020, the U.S. Securities and Exchange Commission (SEC) adopted amendments to modernize Exchange Act Rule 15c2-11.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder