Buy-side equity traders favor electronic trading for cost, but commission dollar requirements and other issues often curtail use.

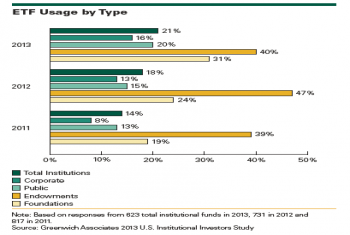

ETF usage is climbing as institutional investors adopt for routine portfolio functions and as a means of obtaining long-term strategic investment exposures.

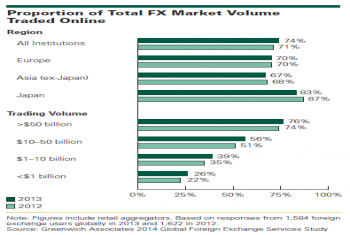

Greenwich Associates research finds top foreign exchange dealers can expect increasing market share concentration, while top fixed-income dealers should see more fragmention.

Online Corporate Banking: A Guide to the Latest Platform Features and Functions

Greenwich Associates used top-line findings from its unique Online Services Benchmarking research to present companies with a detailed and updated guide to the capabilities now available from online corporate banking platforms.

Greenwich Associates believes the current drop off in FX trading activity could reflect not just a cyclical decline but also a major shift in the FX business model.

What is Market Structure and Why Should You Care?

The term market structure is more than just financial jargon; understanding its definition is critical because it likely affects your business by providing either opportunities or headaches.

Ways to Win in a New Investment Environment

Identifying market trends and analyzing feedback from institutional investors, Greenwich Associates recommends four actions for asset managers to consider to best position themselves for success in an increasingly competitive environment.

Almost three quarters of global foreign exchange trading volumes (74%) were executed through electronic systems last year, up from 71% in 2012.

Cleared Derivatives Processing: A Strategic Approach

The shift to central clearing should streamline trade processing over the long term, but industry collaboration is key.

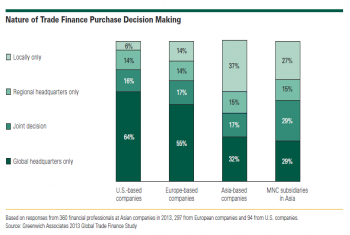

Booming Asian Marketplace Offers Potential for Trade Finance Savings

As increased capacity in Asia pushes trade finance pricing down in the region, regulations threaten to nudge it up.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Efinancial Careers: Despite being small by the usual standards of fixed income trading desks, the...March 28, 2024

-

The Trade: Leveraged loan trading revenue topped $900 million in 2023, up 16% from 2021 and 29%...March 26, 2024

-

Traders: “It’s the infrastructure and technology that has been built over the past 10 years...March 20, 2024