The Evolution of Market Data Desktop Technology

Greenwich Associates research shows that an impressive 69% of study participants use their market data desktop solution’s mobile capabilities.

Greenwich Associates research shows that an impressive 69% of study participants use their market data desktop solution’s mobile capabilities.

Better-capitalized U.S. dealers are picking up a growing share of fixed-income trading volumes in Europe.

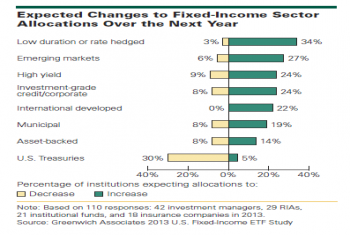

Fixed-income exchange-traded funds (ETFs) are poised to take on a bigger role in institutional portfolios.

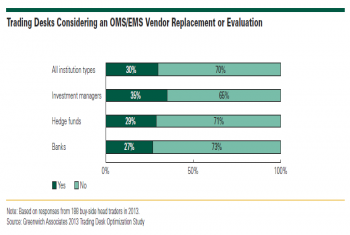

Thirty-nine percent of fixed-income desks reported a year-on-year budget increase and 30% are considering a change in the providers of their order management systems (OMS) or execution management systems (EMS).

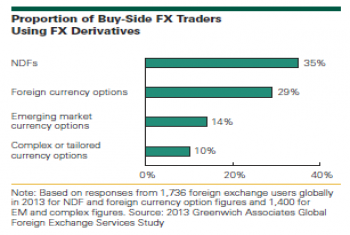

Regulatory-driven changes on the horizon will drive futures to become an important tool in foreign exchange traders’ toolbox.

Most swaps clearing members have been underpricing their offerings to gain market share since inception: This is about to end.

The report examines 486 buy-side firms’ trading technology usage and spend, as well as their satisfaction ratings of major vendors.

Firms should evaluate international expansion efforts in much the same way a portfolio manager evaluates a new investment decision.

One of the biggest drivers of demand for ETFs among RIAs today is investors’ need for passive exposures as part of core/satellite portfolio models.

More than one-third of U.S. pensions, endowments and foundations using ETFs expect to allocate more to the funds by 2014.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder