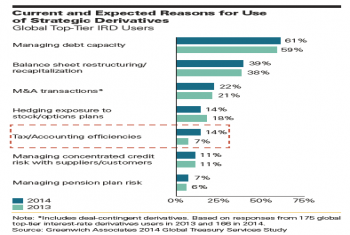

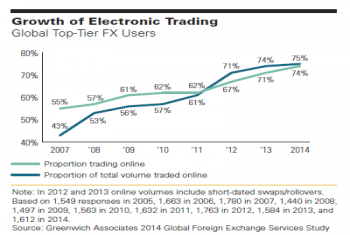

Corporate Derivative Use Continues to Grow—Dealers Say Not So Fast

While new regulations haven't dampened corporate treasuries' use derivatives, the current environment is making profits more elusive for dealers.

While new regulations haven't dampened corporate treasuries' use derivatives, the current environment is making profits more elusive for dealers.

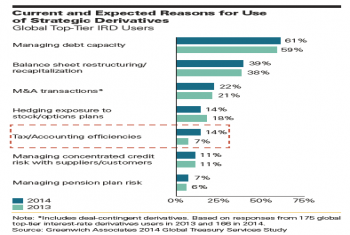

Greenwich Associates identifies the "Best-of- Breed" electronic banking platforms.

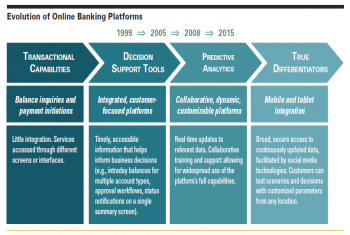

The top five FX dealers saw their market share slip to 51% from 53% in the past year—that 2% is a big deal in a market with turnovers measured in the hundreds of trillions.

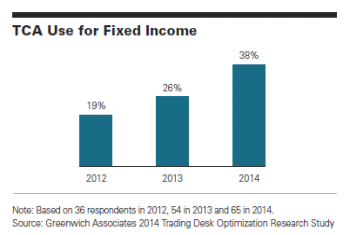

More than one-third of investors use TCA as part of their fixed-income trading process, up from 19% just two years ago.

The walls separating traditional bank channels from the digital world are breaking down fast, and banks' customer experience efforts must keep pace.

With an impressive 79% of institutional investors using social media at work, Greenwich Associates research shows that social media is offically part of the financial services mainstream.

With bonds expensive and providing little income potential, investors are looking for more attractive opportunities...

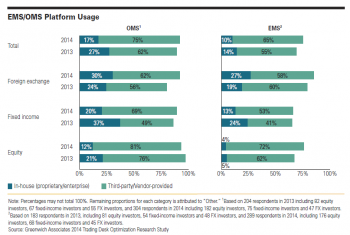

75% of institutions’ OMS platform usage is now with outsourced solutions, while 84% use third-party providers for EMS platforms.

The other major trend coming out of this technology rationalization is the push to form new market utilities and expand the use of existing platforms.

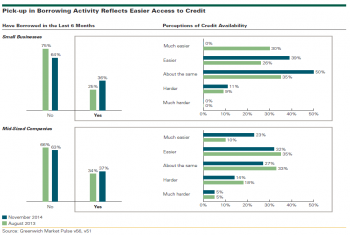

Bank satisfaction levels remain so high among small businesses and mid-sized companies despite widespread fears that new regulatory compliance demands would have a negative impact on clients and damage customer satisfaction levels.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder