As MiFID II turns up the pressure on the delineation of payment for research versus execution, institutional investors may soon increase their attention on brokerage services that materially enhance multiple aspect of their execution process.

Designed to drive alpha generation as well as provide reporting and best execution oversight, broker-provided TCA continues to grow in value as both market structure complexity and the push for transparency swell. For clients, TCA is a free service, but for brokers it’s an investment that they likely won’t be able to fully monetize in the near future. The quality and extensiveness of the offering, however, may secure their position on an institution’s shortlist.

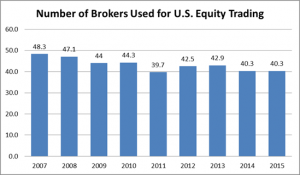

For the past decade, institutions have incrementally reduced the number of brokers they use for U.S. equity trading. European-centric regulations, like MiFID II, may seem distant to U.S. investors, but such a seismic shift could put greater pressure on this downward trend. As our recent report, Equity TCA: Drive Toward Alpha Generation Continues, finds, inadequate TCA tools may be key to the difficult choices that will determine which brokers are cut.

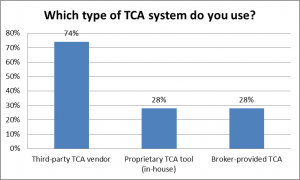

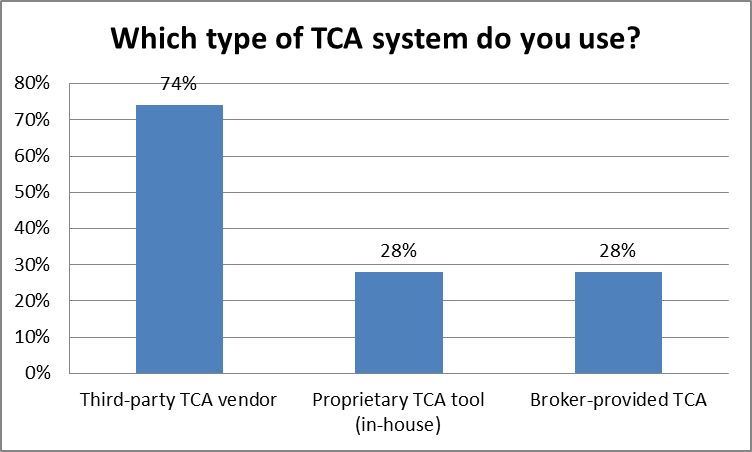

At present, the use of broker-provided TCA by institutions is equal to that of their in-house technology but far below third party vendors. With only 28% of TCA broker-provided, the opportunity exists for each broker to stand out amongst competitors for a place on tighter buy-side lists with more robust analysis.

Unfortunately for brokers, any influx of revenue attributed to their development will be underpinned by the reality that investing in TCA tools is a costly process. As brokers try to maintain profitability with declining trade commissions, developing or enhancing a free service for clients is hardly a favorable use of precious resources.

In addition to cost, the limitations of broker-provided TCA are particularly hampering. Even the most comprehensive broker TCA can only analyze trades executed with its own technology – fundamentally lacking for firms needing aggregated details across brokers.

While these factors will likely stub the growth of broker TCA, brokers will need to balance the demand for more detailed information with the reality that investment in TCA tools may be more about meeting a standard offering to the buy-side.

In any case, no broker will want to be the one with an empty checkbox when the buy-side’s hand is inevitably forced.