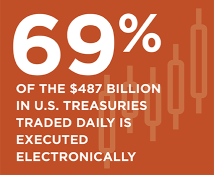

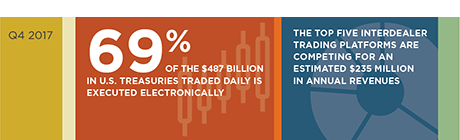

Close to a half trillion dollars in U.S. Treasury bonds trade every day, and Greenwich Associates estimates over two-thirds of this volume trades electronically.

Despite the market’s size, few have a complete view of exactly who is doing the trading, what they’re trading, where they’re trading it, and exactly how those transactions are completed.

Considerable research has been done examining the various segments of this market. For instance, Greenwich Associates has, in recent years, examined the interactions of institutional investors with traditional dealers, the role of principal trading firms, and the mechanics of the off-the-run market, among others. However, research quantitatively defining the entire market and each of its segments has so far been limited.

This relative lack of transparency was brought to the attention of policy and rule-makers following the flash rally of 2014. Transparency is at the center of the debate about public reporting requirements for U.S. Treasury trades and further oversight of market participants. Based on our interviews with over 100 North American investors in U.S. Treasuries, top dealers and non-bank liquidity providers, and each of the eight electronic platforms trading these bonds, this research melds Greenwich Associates primary research with public data to paint a clear and accurate picture of the full U.S. Treasury market, e-trading adoption, platform usage, and our expectations for change moving forward.

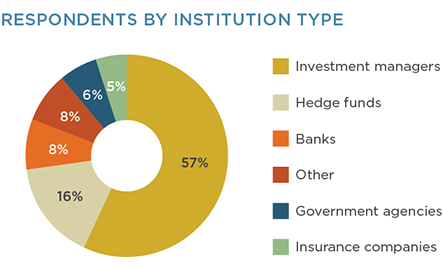

MethodologyIn the first quarter of 2017, Greenwich Associates interviewed 93 U.S.-based buy-side investors in U.S. government bonds, in order to learn more about their use of electronic trading and nonbank liquidity providers. In addition, Greenwich conducted interviews with 20 North American buy-side respondents as a part of the Greenwich Associates 2017 Off-the-Run U.S. Treasuries Study, investigating the ease of executing on- and off-the-run treasuries. Data included is based on these interviews, as well as Greenwich Associates estimates based on conversations with market participants, trading platforms and nonbank liquidity providers.