Capital is expensive and getting more expensive. But the problem is proving a much harder one to manage in Europe, with European banks continuing to deleverage and already complying with the principles of Basel III while US banks have their capital houses (relatively) in order.

The impact of this dichotomy is broad, but one impact already playing out is the growth of US banks in the European Fixed Income market. Recently published Greenwich research based on roughly 1200 European buy side interviews found that every US bank in the top 15 fixed income dealer list gained share in 2013, while every European bank’s market share was either flat or down. The primary reason uncovered was the cost of and ability to commit capital.

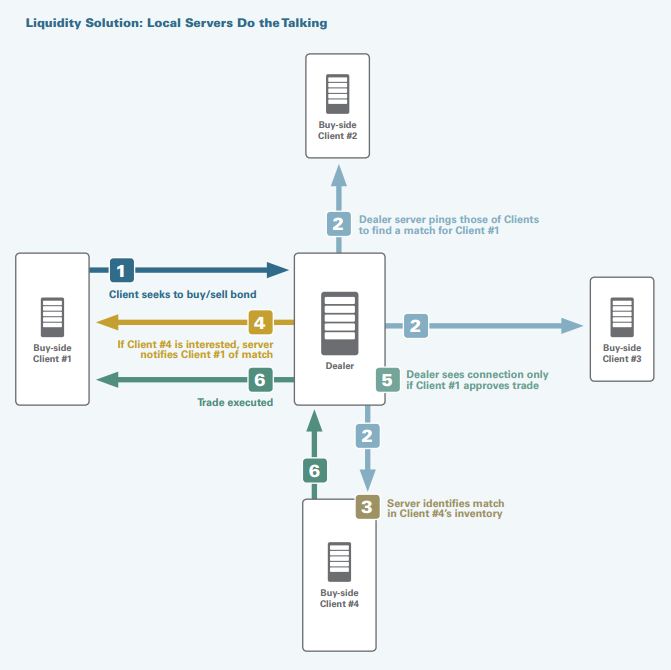

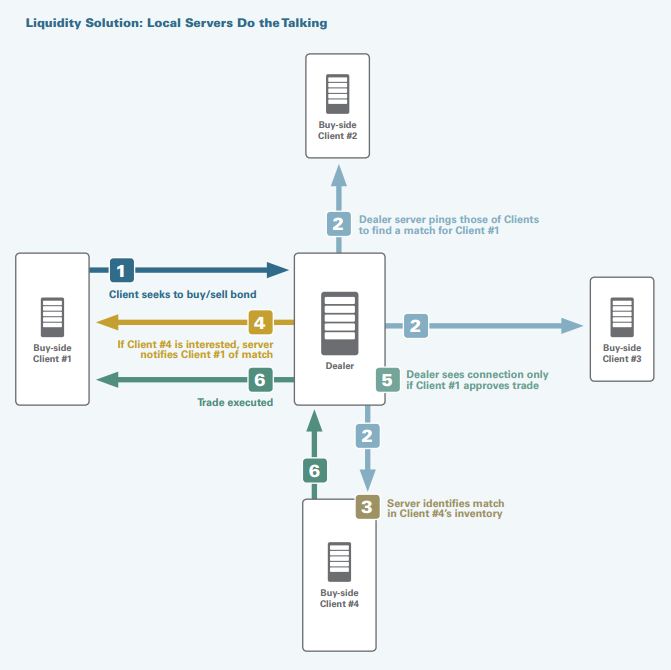

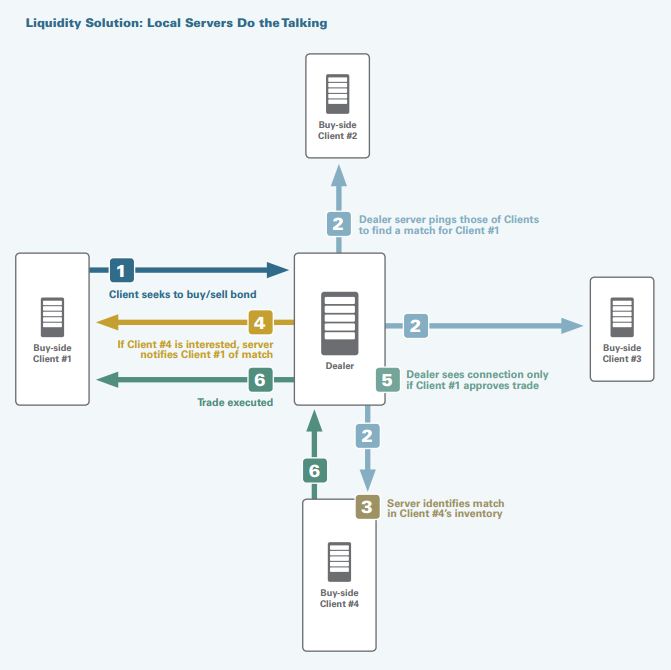

European investors, seeing that the world has changed, are looking to new sources of liquidity as well. New liquidity providers, more electronic trading and new smart matching tools all are seeing increased adoption and success. The report, available to our Market Structure and Technology customers, examines how individual dealers are fairing, detailed trends in electronic trading adoption and suggested new tools for finding liquidity in the bond market.

About Kevin McPartland

Kevin McPartland is the head of market structure and technology research. He has nearly 20 years of capital markets industry experience with deep expertise in market structure, regulation and technology impacting the fixed-income, FX and equity... view more