The market structure supporting the trading of U.S. Treasuries has been under close scrutiny for the past decade. A series of events including the taper tantrum (2013), flash rally (2014), repo market stress (2019), pandemic panic (2020), and Silicon Valley Bank’s collapse (2023) have all kept the tangled web of government overseers wondering what (if anything) needs to be done to make this systemically important market more resilient.

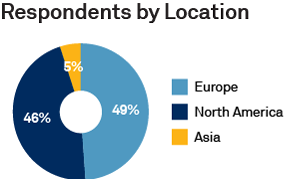

MethodologyCoalition Greenwich gathered responses from 41 U.S. Treasury portfolio managers and traders at asset management firms in August and September 2023. Respondent were based in North America, the U.K., Europe and Asia. Questions were focused on regulatory reform, liquidity and the use of trading technology.