I'm a little obsessed with volatility lately - well, the lack of it actually. The VIX has been hovering around 12 for months despite emerging markets turmoil, rigging scandals and regulatory environment that can only be described as volatile. How can volatility be so low in a market where complexity and uncertainty are so high?

Source: Yahoo! Finance

Source: Yahoo! Finance

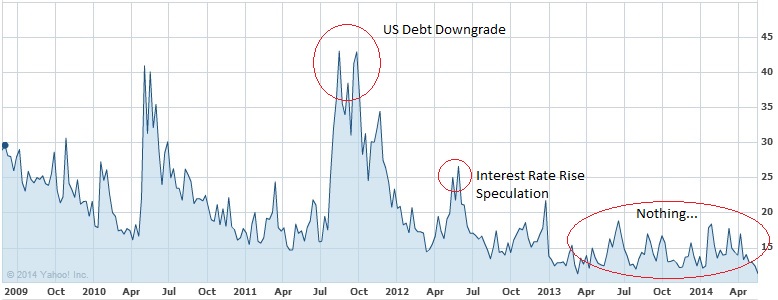

Calm markets aren't a bad thing for everyone. Long only, buy and hold investors have done quite well in this docile equities bull market since 2009. The few volatility spikes we've had have been fixed income related - interest rate increase speculation and the US debt downgrade - which over time only help the equities market. US equity passive index fund holder are sitting pretty in this low volatility environment (despite the market structure debate ongoing that says otherwise). A look up at CNBC as I write this post (on May 27, 2014) shows the Dow near record highs.

The funny thing about capital markets however, is if its too good to be true it probably is. Rising markets are seen as a sign that a crash must be coming, and low volatility as a sign that volatility must be right around the corner - and hedge funds in particular are preparing. According to Greenwich Associate's 2013 equity derivatives study, hedge fund use of volatility derivatives has been increasing - a sign that I'm not the only one expecting volatility in volatility. 43% of hedge funds used volatility options in 2013 compared to 38% in 2012. Volatility based futures saw even stronger growth, with 17% of hedge funds using these products in 2013 up from 9%.

From an institutional perspective, arguably more firms would benefit from an increase in volatility than those long-onlys mentioned above that have enjoyed the calm markets we're in today. The sell side makes money based on the number of transactions it helps execute and the size of the bid ask spread. Low volatility environments bring with them low volumes and low spreads. Active investors also stand to profit as markets get more volatile. The more markets move the more opportunity there is to find pricing discrepancies and good momentum trades. This is exactly why people like to trade on employment numbers and Fed minutes - both tend to make markets move, and moving markets create profit opportunities.

On that point, volatility in the end can be good for long term investors that are well diversified. Those profit opportunities created by volatility aren't only available to institutions, but also to investors in active mutual funds and other dynamic investment vehicles. A whole slew of volatility focused ETFs are also available to a much broader set of market participants, and our research continues to show ETF use is expanding for investors of all sizes. These markets need all of that cash that's been sitting on the sidelines since 2009 to come back into more active investments - whether it be equities, fixed income or real estate. Volatility could be both the cause and effect of those hopeful inflows. I certainly don't want any turmoil in the markets, but some action would be good.