Banks looking to maximize ROI on their massive investments in technology should turn their attention from the digitization of bilateral client relationships to the creation of multilateral digital relationships needed to operate in a new open banking ecosystem.

The process of digitizing bilateral relationships between companies and banks started in the early 2000s and progressed slowly and gradually for nearly two decades. Digitization shifted into overdrive during the global pandemic, turning a bank’s digital capabilities from a nice-to-have feature into a business imperative nearly overnight.

Today, offerings like digital onboarding, digital forms, electronic signatures, mobile banking, and straight-through processing (STP) transactions are standard components of a commercial or corporate banking relationship. Any provider without these basic elements will struggle to win and retain business.

That is not to say that every bank is doing bilateral digitization well. To the contrary, banks diverge extensively in the quality and breadth of their digital propositions. Much of that divergence can be attributed to budgets as well as access to talent. Deep pockets have allowed large banks to create a huge advantage in digital capabilities. That advantage is increasing pressure on small banks to achieve the scale they need to compete in a digital age. Going forward, we believe that pressure will contribute to significant, further consolidation in the global banking industry.

Bilateral Digitization: Still Far from Perfect

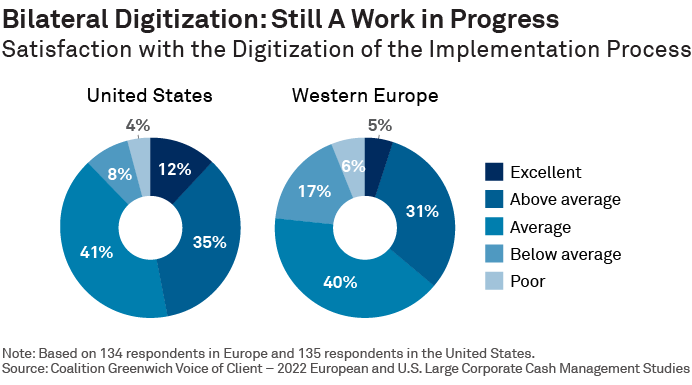

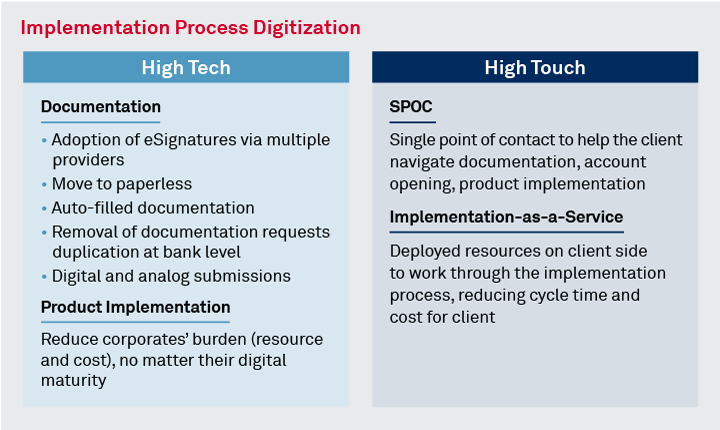

Variance in the quality of digital offerings, however, is not solely the result of size or resource differentials. Some large banking platforms have shortcomings, and some smaller providers punch well above their weight. In general, companies remain less than satisfied with the digital solutions banks have developed for onboarding, which remains a cumbersome process due to KYC and ALM documentation requirements. Around the world, companies complain about the lack of digital pre-filled forms and banks’ continued reliance on a complex and long product-implementation processes. The following graphic shows the low levels of satisfaction companies have with their banks’ digital implementation.

Why are some banks still falling short when it comes to digitizing bilateral banking relationships? Companies participating in our global research say underperforming banks fail to consult with them when developing new digital products, skimp on implementation support and ongoing client service, or don’t make them aware of new digital products and services.

Make no mistake: Banks viewed as lagging competitors in digital capabilities are at risk. From companies’ perspective, bilateral digitization has become table stakes—in particular in product offerings such as cash management. Banks that can’t provide it will quickly be eliminated from consideration as viable providers. Banks that do it well won’t necessarily gain an advantage, but they will remain in the competition for relationships and business.

So how can banks differentiate themselves and build competitive advantages with their technology budgets? To stand out today, banks must establish themselves as leaders in the next phase of digital transformation: multilateral digitization.

Key Questions for Banks:

- Are we equipped with the fundamental capabilities that top-tier digital players provide in the markets where we operate?

- Do we collect and act on feedback from our digital platform customers?

- Do we keep our customers informed about our digital strategy and translate their feedback into actionable steps on our roadmap?

Key Question for Corporates:

Which are the most time-consuming and manual processes with regards to the management of transactions, onboarding and general banking relationship management? Ask banks for support in finding solutions, since they might already have some functionalities that could make a difference, but you may not be aware of.

A New Digital Ecosystem

Around the world, a new digital banking ecosystem is taking shape. Consisting of banks, nonbanks, fintechs, and a host of other emerging players, this ecosystem is being built on a foundation of cloud computing, APIs and “open banking” rules.

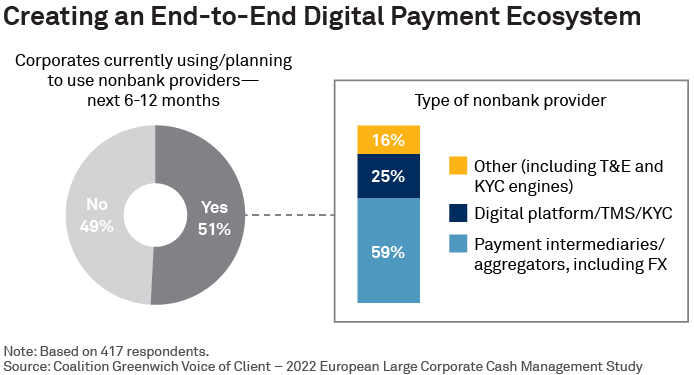

Eventually, this global framework will facilitate multilateral digitization in virtually all banking, corporate treasury and finance functions. By connecting players up and down the chain, multilateral digitization is already moving the industry closer to goals like an end-to-end digital payments infrastructure, true STP for transactions and the full digitization of the credit process. Almost 60% of large European corporates are already using at least one nonbank/fintech intermediary or aggregator for payments or FX, citing usage of providers such as Adyen, Stripe, Worldpay from FIS, and many others.

From an operational perspective, industry-wide digitization will bring more transaction transparency, better forecasting capabilities, enhanced AML reporting, and even an ability to embed documentation references within transactions. Additional fields made available via ISO20022 migration is a step in the right direction.

Data sharing becomes a pivot component of payments transformation. Through digitized, multilateral relationships, banks and other players can access both publicly available and proprietary data that has been permissioned by the owners through new open banking rules and applications. This increased flow of data will have huge implications for the banking industry, due to its ability to fuel increasingly powerful artificial intelligence (AI) applications.

Key Questions for Banks:

- Have you asked your clients about the third-party services they are currently utilizing and their specific purposes?

- Considering bank-to-bank or nonbank financial institutions relationships, have you explored potential partnerships with some of the most-used aggregators to tap into a portion of the transaction volume they handle?

Key Questions for Corporates:

- When you're creating your Request for Proposals (RFP) or searching for new service providers, do you consider nonbank financial institutions as potential options?

- Have you relayed any of the best practices from third-party partners to the core providers in your banking pool, particularly concerning aspects like onboarding, pricing and the user-friendliness of the platform?

Innovation, Connections and AI-Powered Insights

In the industry’s next phase of multilateral digitization, banks will differentiate themselves by their ability to provide access to end-to-end digital solutions and STP, and by their proficiency in harnessing powerful predictive analytics to provide companies with insights and forecasts in cash flow and liquidity management, payments, and even carbon emissions and other ESG-related indicators.

However, it is important to note that the digital ecosystem that will support these products and services is still very much a work in progress. Infrastructure and regulations are still being constructed, and banks are still assembling the technology platforms and legal and compliance frameworks needed to operate in this new environment. That’s not even to mention the corporates themselves, many of which are nowhere near being aware, let alone advanced enough to take full advantage of these innovations.

For these reasons, banks all the way down to local players must make digital transformation a top strategic priority. That means staking out an innovation strategy based on some combination of internal development, cooperation with third-party technology providers and relationships with fintechs—including both partnerships and acquisitions.

Now that the age of bilateral digitization is coming to an end, banks must position themselves for the next phase of industry evolution by revamping their own technology platforms and helping their clients make the challenging journey to a world of multilateral digital banking relationships.

Tobias Miarka and Ana Voicila are the authors of this publication.