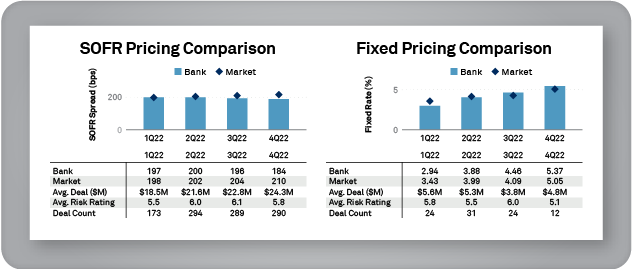

Commercial Loan Analytics (CLA) gives banks unique market insight to help them optimize their commercial loan portfolio. Our analytics are back by a robust data set of commercial loan and fee transactions from the leading banks in the U.S., forming the basis of our benchmarking for loan pricing and portfolio composition.

Our experience in cleansing and standardizing commercial loan data, combined with our strong business knowledge and analytical methods, enables us to understand detailed loan trends and pricing levels in the U.S.

Peer benchmark data is critical to optimize your commercial loan business, enabling you to:

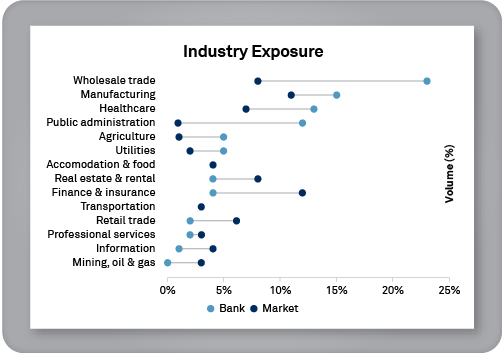

- Set an appropriate market strategy informed by leading data that identifies premium and discount markets with mismatches between clearing prices and pricing norms

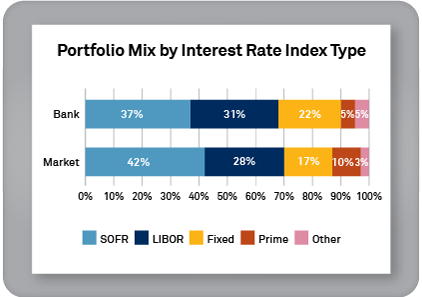

- Evaluate your commercial loan portfolio allocation and see how that compares to relevant peer banks to be best prepared for economic headwinds

- Identify and take advantage of opportunities in the market by pricing more competitively to improve win rates

Clients have seen loan spreads expand by 12–15 basis points and fee pricing increase by 3–5 basis points within one year of incorporating Pricing Guidance.

- Our granular market data allows you to understand pricing differences across multiple characteristics, such as geography or industry, and how current pricing has trended over time

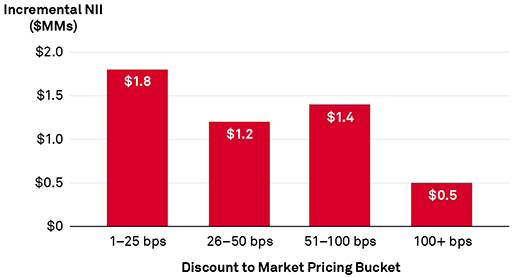

- Targeting specific loan types for pricing realignment allows you to grow NII through both renewing and newly originated loans

The quarterly Commercial Lending Market Insight can help banks understand their performance and shape strategic plans.