Corporate bond investors are well taken care of. Markets are more transparent, electronic and generally more accessible than they’ve ever been. The path to this point certainly wasn’t smooth. In the early 2000s, TRACE reporting, MarketAxess and Tradeweb all launched with considerable industry pushback. In 2008, over the span of just a few months, investors effectively lost access to dealer balance sheets that for decades they had taken as a given while dealers struggled to move forward under the weight of new regulations and a crashed market.

Only a few years later, however, fortunes finally changed. With the 2010s came a tailwind for innovation driven by investors and dealers, all of whom were searching for a new operating model that would work in this new world. And now, nearly 15 years later, almost half of global bond trading is done electronically, data is in such abundance that market participants struggle to use it all and equity-style execution algorithms are reality. What else could the buy side want? Plenty.

Auto-Quoting Tops the List

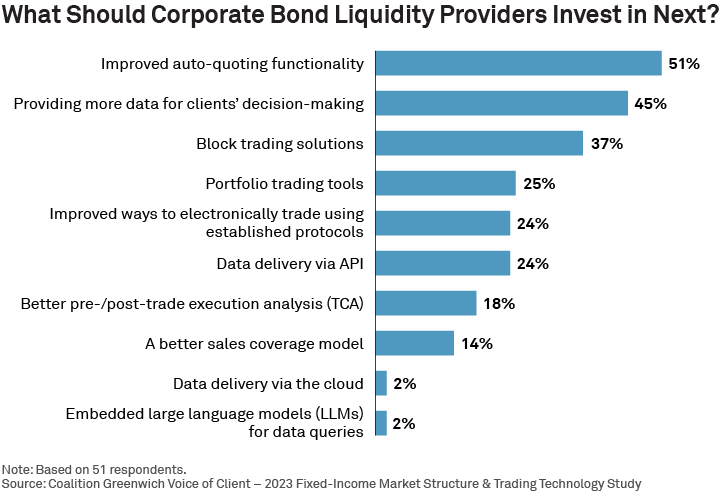

In the fourth quarter of 2023, we asked 51 corporate bond investors, mostly in the U.S. and Europe, what they’d like their liquidity providers to focus on next. Improved auto-quoting topped the list, while cloud computing and large language models were at the bottom. The former overtly impacts trading outcomes throughout the day, whereas the latter is behind the scenes—and focusing on right now is what traders are paid to do.

Recency bias means that many forget how much auto-quoting has improved. In March 2020, several of the largest banks famously shut down their auto-quoters as the pricing algorithms couldn't keep up with the unprecedented volatility. That fail provided a learning opportunity for the algos and the humans at the wheel, allowing those same auto-quoters to handle more recent volatility e.g., the regional bank crisis) without a hitch. Nevertheless, the buy side still wants more. Response times and spreads on liquid names are appreciated, but quicker responses on less-liquid bonds (or any responses at all) are increasingly in demand.

Improving the Block-Trading Process

New and improved solutions for trading blocks also ranked highly. We dove deeply into current block trading processes and the buy-side/sell-side dynamic in research published in December 2023, so we won't retread that ground here. But block trades remain the Holy Grail for bond market electronic-trading supporters. And while the buy side values their counterparty relationships and the liquidity and market color they bring, improving the block process (even if some of it remains offline) is a focus.

Beyond Raw Data

Last but not least, the buy side wants more data. On one hand, of course they do. Information is power. On the other, the majority of asset managers we speak with are overwhelmed with the data they already have and struggle to put it to work. But dealers can offer something that goes beyond evaluated prices or TRACE prints. They can provide clients with actionable analysis of their trading performance, and recommendations to improve outcomes—a big step beyond raw data.

It is interesting, then, that transaction cost analysis (TCA) was ranked so far down the list. That suggests that TCA has a branding problem, viewed as a report card (who likes getting a report card?) rather than a source of market intelligence. And market intelligence is the lifeblood of the trading desk.

All of these asks are predicated on counterparty relationships in which mutual trust exists and are further enhanced when the client feels like their sell-side counterpart really understands what they care about, how they trade and what a successful outcome looks like. Old-fashioned relationships and the best technology both win business but, increasingly, only when the two are smartly intertwined.

Kevin McPartland is the author of this publication.