Table of Contents

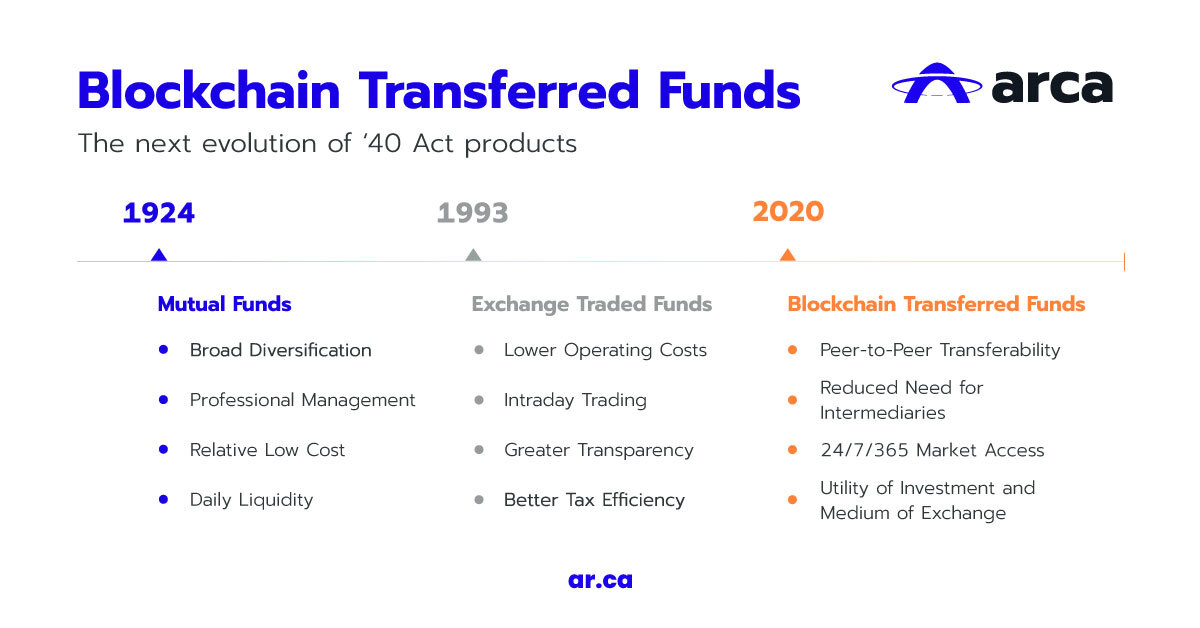

The evolution of investment funds happens slowly—sometimes at a glacial pace. While U.S. securities laws and regulations that apply to investment funds are time-tested, they were written decades ago and do not take into account the market structure and technology of today. And while technology innovation often changes how we invest and trade, until recently, it has rarely shifted what we trade.

Investment Funds in a Digital Asset World

Coalition Greenwich recently conducted wide-ranging research examining how blockchain technology has the potential to create disruption and challenge assumptions in the global capital markets industry. We examined both the evolving market structure for trading crypto assets and how blockchain technology can help to transform the traditional finance (TradFi) market.

From our research and conversations with market participants, it has become increasingly clear that greater regulatory certainty is needed before traditional investors can further embrace the digital asset ecosystem. Tokenized investment products, including investment funds and other pooled investment vehicles created under the Investment Company Act of 1940 (’40 Act) are a step toward greater institutional adoption of blockchain technology. The first iteration of a pooled investment vehicle combining blockchain technology with regulatory clarity is the blockchain-transferred fund (BTF).

BTFs Challenge ETFs

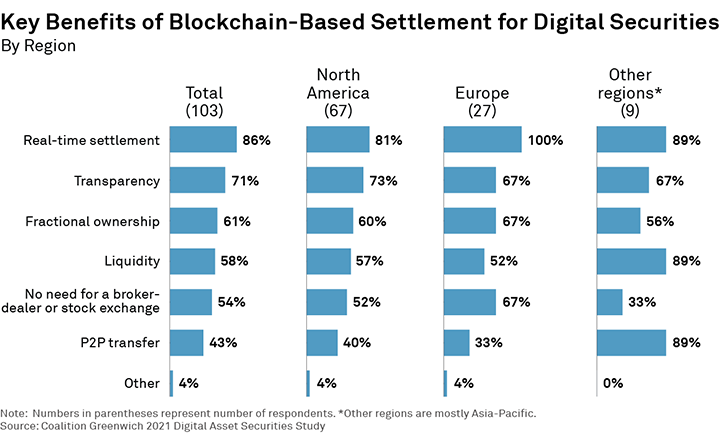

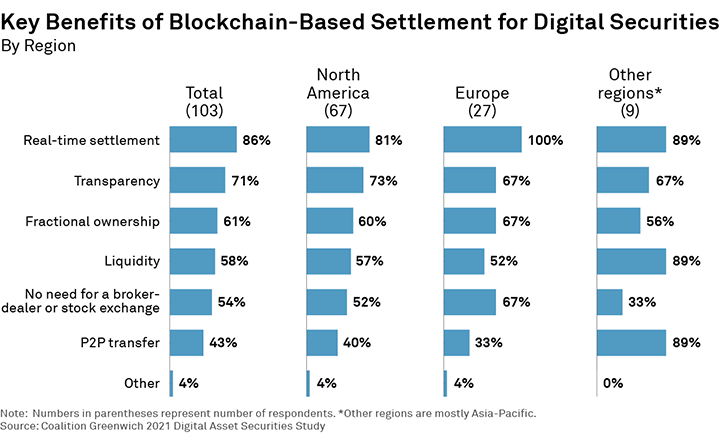

Today’s investment structures were designed in a different technological, legal and cultural context. While exchange-traded funds (ETFs) are almost 30 years old and still growing their asset base, digitization is starting to introduce competition to existing fund structures. For the investment fund industry, blockchain technology has now fully arrived on the scene, with real, tangible benefits for investment funds—including real-time settlement and an immutable, transparent, distributed ledger.

Beginning in 2020 investment vehicles built atop blockchain technology set out to challenge the assumption that, for many investors, ETFs will remain the preeminent investment vehicle of choice over the next decade. ETFs were originally designed to address some of the flaws of mutual funds and offer low-cost investment opportunities to retail and institutional investors alike. But the rise of blockchain, 24/7/365 markets and broader digitization efforts offers a new approach.

Benefits of BTFs

The BTF is defined as a Securities & Exchange Commission (SEC)-registered investment fund that is both natively issued and transferred entirely through a blockchain. The Arca U.S. Treasury Fund, and the fund’s digital asset security shares called ArCoins, is a prime example.

Put simply, BTFs are investment vehicles that are natively created on the blockchain and registered with the SEC as ‘40 Act funds—combining regulatory certainty with innovative technology.

Source: Arca Lab

Source: Arca Lab

Like the ETF before it, the BTF offers improvements over the existing fund structures available. For instance, blockchain-based settlement offers new efficiency in fund administration, transparency and other benefits for a variety of participants, including fund issuers, service providers, intermediaries, and investors. In fact, among respondents to our research study, 67% of digital-asset-savvy market participants agree that efficiency in fund administration is the top benefit of tokenized funds.

The BTF in Practice

You may be wondering how this all works in practice. Let’s say an investor purchases shares in the Arca U.S. Treasury Fund, whose mandate is to invest at least 80% of its assets in U.S. Treasury bills, bonds and notes. ArCoin (a digital asset security) is a share of that fund, and the net asset value (NAV) of ArCoin varies with the value of the fund’s portfolio of securities. Since the fund is registered under the ’40 Act, an investor will receive mandatory reporting, including audited financials, semiannual reports, trade confirmations, and monthly statements, a daily NAV, and regulatory filings. So, the token tracks the fund’s NAV, which is tied to a portfolio of U.S. Treasury securities.

While ETFs have become ubiquitous in modern investment portfolios, the potential for BTFs to challenge ETFs cannot be ignored in the long run, as the BTF structure offers a powerful combination of technology innovation built atop regulatory clarity. And while adoption thus far is limited at this early stage, positive market sentiment continues to grow.

Moreover, as an ecosystem around BTF participants emerges, other second-order networking benefits are also present in areas such as collateral management, compliance and stablecoin alternatives. These are certainly exciting times for regulated products and innovative technologies to team up.

Further Reading

For more information on the Arca Labs report on BTFs, for which we were a contributing author, please see here.

Anyone also interested in the structure of digital assets and the growing intuitional interest in ETFs and products in the space, please read our recent report Digital Asset Market Structure: Institutions Take the Reins.