Table of Contents

- 1.Greenwich Share and Quality Leaders—Large Corporate Banking

- 2.Greenwich Share and Quality Leaders—Middle Market Banking

- 3.Digitization Driving Competition for Banking Relationships

- 4.Indian Corporates See Positive Business Environment Ahead

- 5.ESG: An Opportunity for Indian Banks

- 6.Greenwich Excellence Awards

India’s private banks are on the ascendancy. At the top of the corporate banking market, the country’s three biggest private banks, in aggregate, have gained a large share of deeper relationships among large and middle market corporates.

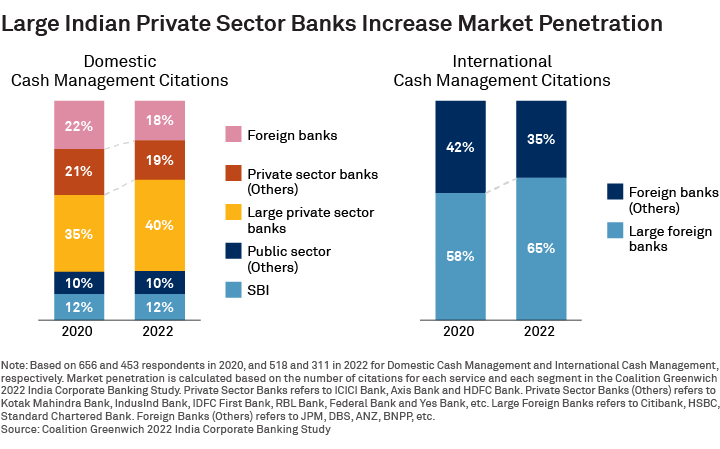

India’s private sector banks got a major boost from the Reserve Bank of India’s 2020 circular establishing new rules on current accounts—effectively ensuring a minimum size relationship that corporates have with their bank, which strengthened the competitive advantage of large corporate lenders. Aided by that tailwind, the market penetration of large private sector banks (HDFC Bank, Axis Bank and ICICI Bank) for domestic cash management has climbed from 35% in 2020 to 40% in 2022. In the international cash management space, the same tailwinds have helped large foreign banks (Citi, HSBC and Standard Chartered Bank) increase market penetration from 58% in 2020 to 65% in 2022. This is not to say that other leading banks are not benefiting, however, given the overall growth in the economy.

There is much more to this performance than favorable regulation. Over the past few years, private banks have been winning over corporate clients by providing innovative digital offerings with a much faster speed-to-market compared to even the global banks.

Greenwich Share and Quality Leaders—Large Corporate Banking

The country’s domestic banks have taken advantage of these regulatory shifts and technology innovation to dominate the list of 2022 Greenwich Share and Quality Leaders in Indian Large Corporate Banking. At the top of that list is State Bank of India (SBI), which still outpaces all competitors in market share by a sizable margin, followed by ICICI Bank and HDFC Bank. Among local Indian banks, HDFC also claims the title of 2022 Quality Leader, along with Axis Bank. Among foreign banks, the 2022 Share Leaders are Citi, HSBC and Standard Chartered Bank, and the 2022 Quality Leaders are Citi and Standard Chartered.

Greenwich Share and Quality Leaders—Middle Market Banking

In the middle market space, the 2022 Greenwich Share Leaders among domestic providers are HDFC, ICICI and Axis. The 2022 Quality Leaders are Axis and HDFC. While this market segment is dominated by domestic providers, among foreign banks competing in the middle market segment, the 2022 Greenwich Share Leaders and the 2022 Quality Leaders are Citi, HSBC and Standard Chartered Bank.

Digitization Driving Competition for Banking Relationships

Even prior to COVID-19, digital payments and digital banking were given a big impetus, thanks to the government initiatives like “demonetaization,” UPI (Unified Payments Interface) and UIDAI (Unique Identity Authority of India). However, coming out of the pandemic, digitization and digital integration have really become top priorities for Indian corporates. Indian companies are optimistic about their country’s economic outlook—considerably more so than corporates elsewhere in Asia. As they embark on a new cycle of capital expenditures in preparation of expected opportunities for growth, they are looking for new ways to optimize working capital management and maximize cash flows.

Indian Corporates See Positive Business Environment Ahead

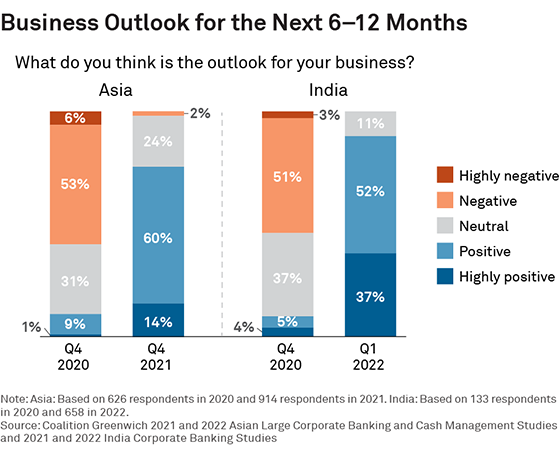

Indian corporates are sanguine about the near-term outlook for their businesses. Although companies remain somewhat cautious about uncertainties currently unfolding in the post-COVID marketplace, on the whole, Indian corporates are more bullish about the business environment than their peers across Asia. Within India, the financials, information technology and energy sectors are the most optimistic about the outlook for the next six to 12 months.

Digitization will be central to those efforts. When asked to name their top priorities for the coming year, senior corporate treasury professionals place working capital management and digitization of firm-wide treasury processes at the top of the list by a wide margin.

This focus on digital efficiency is playing to the strengths of large private banks, which are now reaping the rewards from significant past investments in digital capabilities and their reputation for speed-to-market. The “digital experience” is having a growing influence over companies’ allocation of their banking wallet, and companies give top ratings to the experiences provided by private banks. Of all corporate banks competing in India, HDFC Bank gets the highest scores in client ratings of digital experience, followed by Axis Bank, Citi and ICICI Bank.

At least some of the credit for these high scores has to go to the Reserve Bank of India (RBI) and the India Banks Association for the creation of the National Payments Council of India (NPCI) and its system for payments and settlement. In most countries, local banks struggle to match the technology stack of global banks competing in the market. The establishment of real-time infrastructure has allowed the country to vault ahead in digital payments and has helped Indian banks roll out innovative digital offerings that, from the perspective of Indian corporates, are as good as or better than anything from the global banks.

The impact of that innovation can be seen in the recent performance of smaller Indian private banks. From 2020 to 2021, the aggregate market penetration of India’s “other” private sector banks (all private banks excluding HDFC Bank, Axis Bank and ICICI Bank) climbed from 3% to 5% in overall corporate banking where firms cite a “lead” relationship—a milestone.

ESG: An Opportunity for Indian Banks

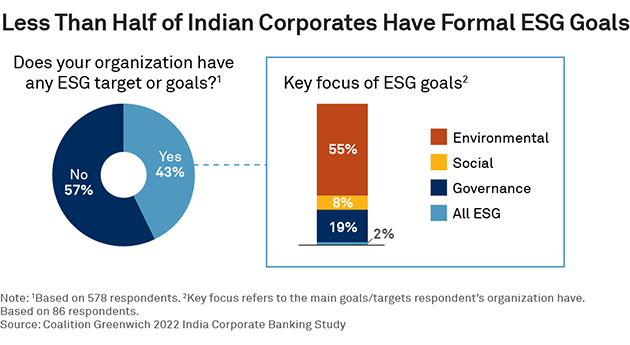

Indian banks have a critical opportunity to deepen relationships with corporate clients and make a positive impact by helping large and midsize companies implement environmental, social and governance (ESG) standards and goals.

Nearly a third of large Indian corporates and almost two-thirds of middle market companies have yet to establish clear and tangible ESG goals or targets. In industry segments like real estate, only about 1 in 5 companies have adopted such ESG measures. Across the board, far fewer companies have adopted ESG metrics in their treasury function relative to similar industries Europe, the U.S. and some parts of Asia.

To date, companies say foreign banks have taken the lead on this issue by being the most active in approaching their clients about ESG. But with domestic banks holding a growing number of key corporate banking relationships, they are in a unique position to provide added value to their growing base of clients by advising them on how best to navigate the often confusing world of ESG data and standards—both in their business operations and in their treasury/finance practices.

As observed elsewhere globally, where ESG targets do exist, environmental considerations play a more important role. As ESG standards and norms evolve further and crystallize into more well-defined frameworks, there is an opportunity for banks to partner with firms and help navigate their ESG journey.

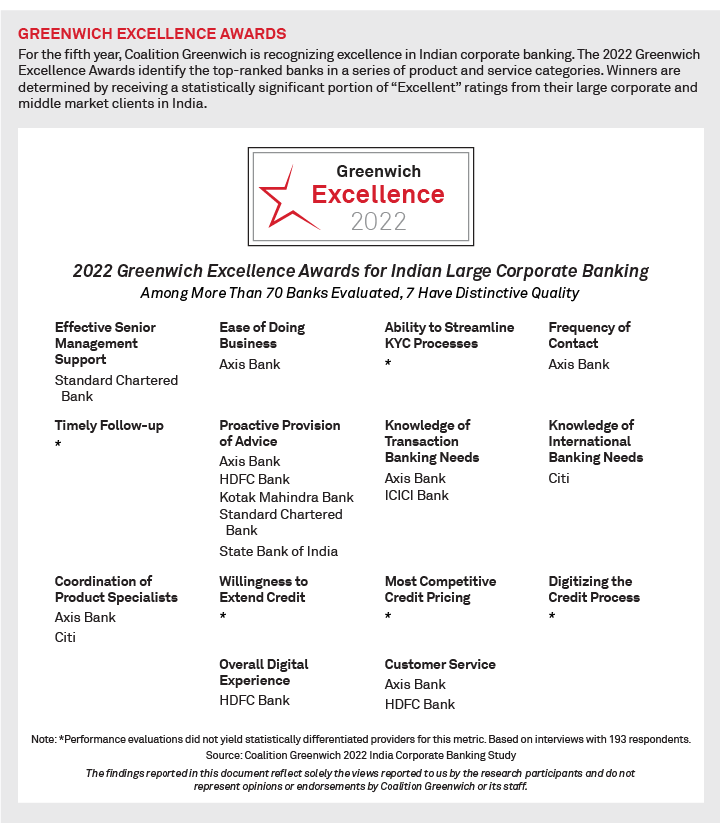

Greenwich Excellence Awards

The accompanying tables present the 2022 Greenwich Excellence Awards winners in Indian Corporate Banking.

Coalition Greenwich Head of Asia, Gaurav Arora, Ruchirangad Agarwal, Wesley Han and Pushpak Vanjari specialize in Asian corporate/transaction banking and treasury services.

For more information: ContactUsAsia@greenwich.com or call +65.6236.0142

MethodologyFrom September 2021 to March 2022, Coalition Greenwich conducted interviews with 193 large corporates and 465 middle market businesses in India and asked them to name the banks they use for a variety of services, including corporate lending, cash management, trade services and finance, foreign exchange, structured finance, interest-rate derivatives, and investment banking.

The Greenwich Quality Index (“GQI”) comprises metrics which measure Institutional Relationship Quality and Overall Coverage (i.e., “People”) Quality. Institutional Relationship Quality factors include “Effective Senior Management Support,” “Ease of Doing Business,” “Willingness to Lend,” “Most Competitive Pricing,” and “Ability to Communicate Upfront on KYC Requirements.” Coverage Quality factors include “RM’s Proactive Provision of Advice,” “Knowledge of Transaction Banking Needs,” “Knowledge of International Needs,” “Frequency of Visits,” “Timely Follow Up on Requests,” and “Effective Coordination of Product Specialists.” Study participants were then asked to rate their banks in 14 product and service categories. Subjects covered included product demand, quality of coverage and capabilities in specific product areas.