Table of Contents

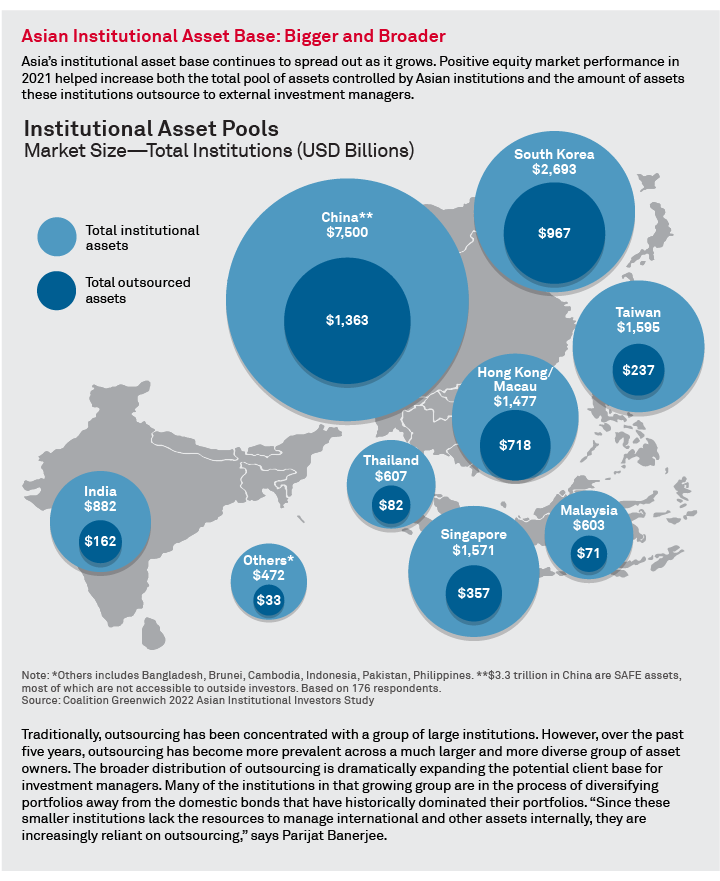

In a year of accelerating inflation, mounting concerns about market volatility and ongoing, pandemic-related disruptions to due diligence and other core business practices, asset owners in Asia continue to work more often with large, established investment managers in traditional asset classes who can deliver stability, along with top-notch client service and advice. At the same time, asset owners across the region are seeking to hire specialist alternatives managers—as long as they can impress with expertise in the specific alternative asset classes institutions are targeting for their portfolios.

Institutions’ preference for large managers with proven track records for performance and client service is playing to the strength of global firms like Allianz Global Investors and PIMCO, the 2022 Greenwich Quality Leaders in Overall Asian Institutional Investment Management. “These firms win plaudits from clients across Asia for both the intensity and the quality of their client service, and for the effectiveness of the advice they provide on macro issues, portfolio construction and asset allocation across the market cycle,” says Coalition Greenwich Head of Investment Management APAC, Parijat Banerjee.

Big investment management organizations that have been able to devote significant resources to environmental, social and governance strategies are benefitting from a spike in demand for ESG. In past years, ESG demand came primarily from Asia’s largest sovereign wealth funds, central banks and other quasi-government asset owners. Over the past 24 months, that demand has spread steadily among the region’s pension funds, insurance funds and other institutional investors. As more Asian institutions adopt ESG criteria, portfolio implementation practices are evolving quickly. “Rather than giving out ESG mandates, Asian institutions are looking to see how managers have integrated ESG into their core investment processes across their platform,” says Coalition Greenwich Senior Manager Arifur Rahman, adding that certain large management organizations like Allianz have been leaders in this type of ESG integration.

Alternatives

Non-traditional asset classes, including both alternatives and multi-asset strategies, currently make up approximately 20% of Asian institutional assets. That share is poised to grow in the next 12 months amid continued strong demand for alternative assets and strategies.

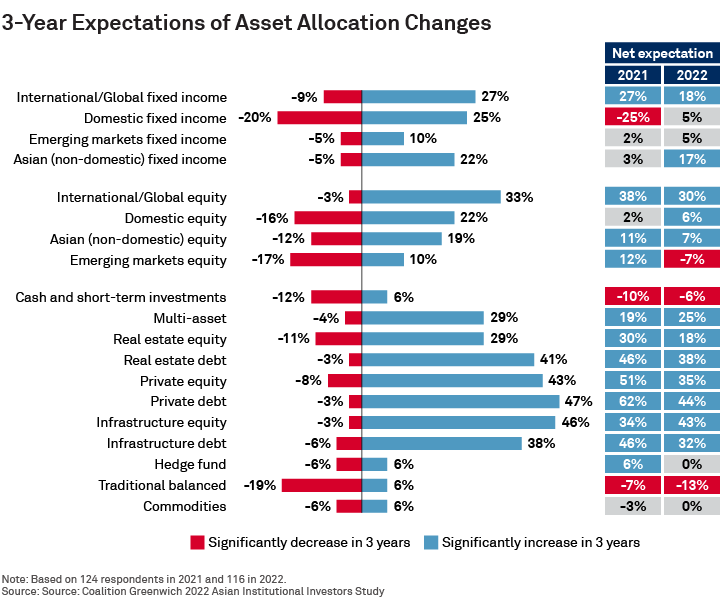

Throughout Asia, institutions’ search for badly needed sources of yield are leading them to alternative asset classes. Private equity now makes up about 4% of Asian institutional assets. Over the next three years, 43% of Asian institutions plan to significantly increase allocations to the asset class. About 47% of institutions expect to make large increases to private debt allocations, and 46% plan to meaningfully boost allocations to infrastructure equity. Roughly 40% of institutions are planning to significantly increase allocations to real estate debt, and nearly the same number are planning increases to infrastructure debt.

When awarding mandates for alternatives, Asian institutions are agnostic about firm size or type. “For the most part, institutions aren’t favoring large multi-asset managers or smaller specialized alternatives shops,” says Arifur Rahman, “As long as you have the track record and expertise, you can compete.”

For example, KKR is a leading private equity manager and is appearing on a growing number of institutions’ manager lists—and winning client quality ratings that are in line with the top traditional managers. “Alternative managers that have made the investments to develop a presence in Asia are riding a strong tailwind of demand,” says Parijat Banerjee.

An Improving Outlook for Fixed-Income Managers?

In 2021, a combination of strong equity performance, anticipation of interest-rate hikes and voracious demand for alternative asset classes resulted in a reduced fixed-income allocation and lower demand for the services of fixed-income managers competing in Asia.

However, a look at Asian institutions’ three-year allocation plans suggests that the tide could be turning—at least for certain fixed-income categories. About 27% of institutions plan to significantly expand allocations to international/global fixed income and 22% plan to boost allocations to Asian fixed income. In both categories, fewer than 1 in 10 institutions plan significant reductions.

“The situation for fixed-income managers has changed significantly over the past six months,” says Parijat Banerjee. “Based on conversations with clients, we think 2021 might have marked a low point for fixed-income allocations, and we expect a much more favorable environment for fixed-income managers ahead.”

The one main exception to that trend could be emerging markets debt, which continues to feel the negative effects of aggressive rate hikes in the United States.

Relationship Director Parijat Banerjee and Relationship Manager Arifur Rahman advise on the investment management market in Asia.

MethodologyBetween February and June 2022, Coalition Greenwich conducted 123 interviews with senior decision-makers at the largest institutional investors in Asia ex-Japan. Senior fund professionals were asked to provide detailed information on their investment strategies, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of managers soliciting their business. Countries and regions where interviews were conducted include Bangladesh, Brunei, Cambodia, China, India, Indonesia, Hong Kong/Macau, Malaysia, Pakistan, the Philippines, Singapore, South Korea, Taiwan, and Thailand.