The federation of business communications channels is set to be a competitive differentiator for firms embracing this paradigm shift. The centralization of all chat and voice communication enabled by federation is an increasingly high priority for many capital markets institutions desiring a way to meet clients wherever they are, without the need to worry about message retention or other regulatory requirements.

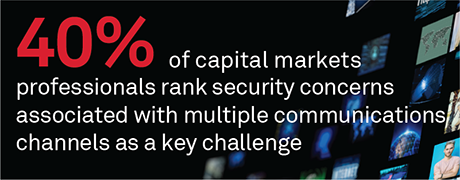

Despite the obvious advantages, adoption remains low as many in the market lack the internal focus or technological wherewithal to make the change. Solutions to meet this challenge certainly exist, and the need for them will only increase as security concerns, the number of regulations and communication channels inevitably grow.

The benefits of federated business communications are largely understood and strongly desired. The aggregation of communications channels into a single interface is viewed as more efficient, more compliant and even cost-reducing. Pockets of centralized business communications often exist for some channels and business lines but not others. As a result, medium- and smaller-sized asset managers, hedge funds, insurance agents, and financial advisors are considering their options to blend together different decentralized communications channels.

MethodologyIn Q4 2023, Coalition Greenwich interviewed 93 capital markets professionals in the United States, United Kingdom and Europe. The majority of participants hailed from the front office versus those occupying compliance, risk and legal positions. Firms under study had under $1 billion in assets under management (AUM). The study focuses on the benefits and challenges firms are experiencing given the proliferation of many types of communication channels and data. For a detailed look at the respondent base, please see the Appendix at the end of this report.