The relationship between large corporates and their cash management providers is becoming stickier with large corporates in the United States, Europe and Asia, evincing a reduced propensity to change providers. These findings are based on interviews with large corporates with a turnover of at least $2 billion, as presented in recent research by Coalition Greenwich.

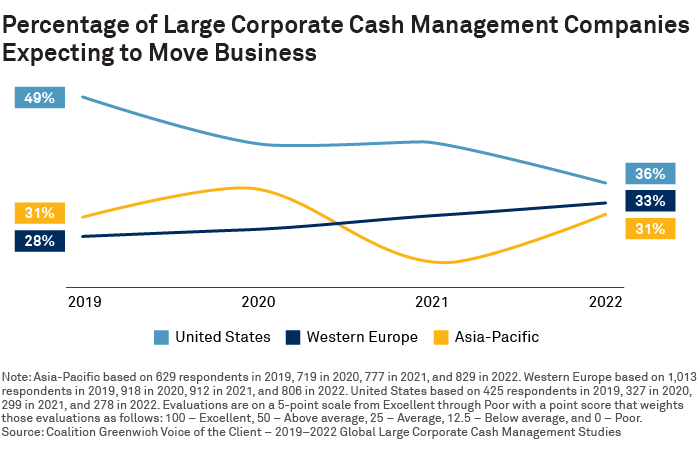

Only 36% of large U.S. corporates expect to change their cash management providers today as compared to 50% four years ago, based on conversations with treasury and finance professionals as part of our U.S. Large Corporate Finance Study. This brings them in line with their counterparts in Europe and Asia.

Key Drivers of Stickier Bank-Firm Relationships

One of the key reasons for this is digitization. As corporates adopt proprietary bank platforms and complex products that require significant investment, they are less likely to move their business. This strengthens existing bank-firm relationships and works in favor of leading banks that have the product capabilities to meet the growing complexity of these corporates’ needs, especially in areas like cross-border cash management.

There’s also the fact that historically, corporates are less likely to move business from strong and established relationships during times of economic uncertainty.

Customer Service, Pricing and International Network Are Top Selection Criteria

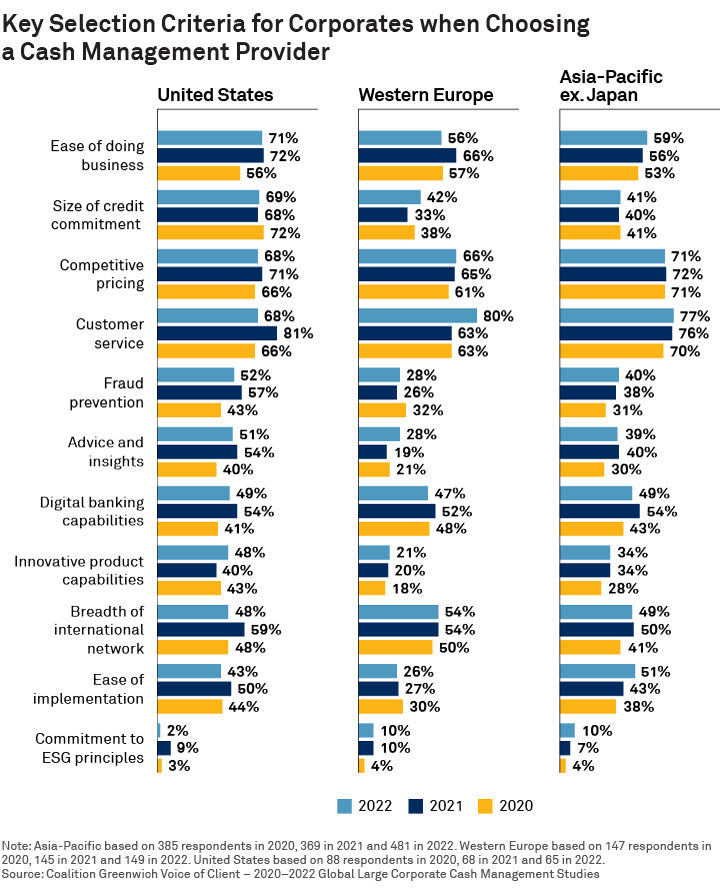

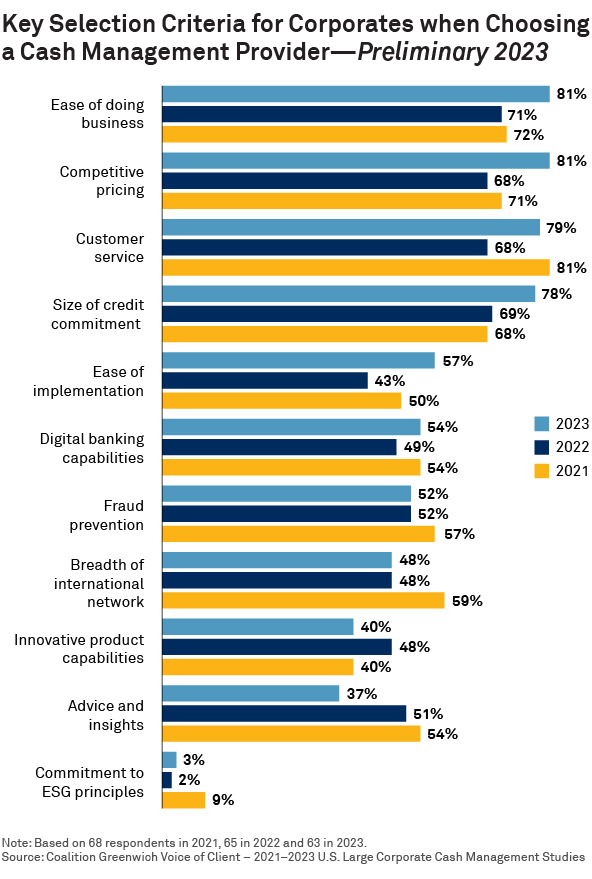

Customer service and ease of doing business are the paramount attributes corporates seek when selecting a cash management provider. That’s apart from pricing, of course. Cash management continues to be an extremely price-sensitive market—this factor is regaining importance after a small decline seen during the pandemic.

There are some regional differences, though. A bank’s international network is important for large corporates in Europe, given the high volume of cross-border transactions there, and for those in the export-oriented markets of Asia.

For large corporates in the U.S., meanwhile, the size of the credit commitment is a top criterion for cash management and treasury services. Again, this works in favor of the big banks, which have both the capabilities and balance sheet strength to anchor themselves in the relationship with the corporates.

Corporates who wish to share their perceptions in the U.S. Large Corporate Finance Study can do so by reaching out to us at contactus@greenwich.com. In recognition for sharing their perspective, participants will receive access to the Greenwich Exchange, an experience and source for connecting financial professionals to industry insights. This access includes robust, trended and actionable data to inform decision-making and enhance relationships with banks.

Tobias Miarka and Matthew Noujaim are the authors of this publication.