The big three U.S. banks have rebounded from the COVID-19 crisis with a greater share of the market.

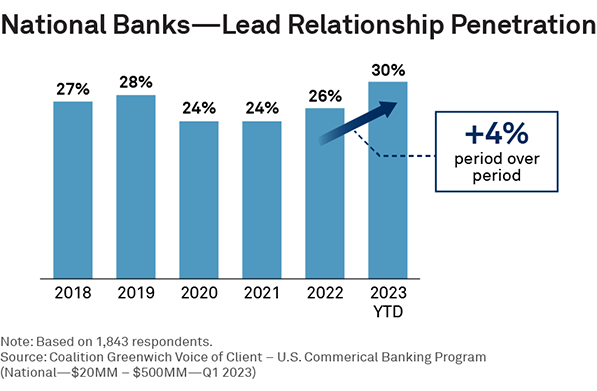

In 2019, the big three U.S. banks—Bank of America, JPMorgan Chase and Wells Fargo—held lead commercial banking positions with 28% of small businesses and midsize companies. During the pandemic, that share dropped to just 24%.

A big portion of that decline can be attributed to perceptions among some commercial baking clients that these banks were slow to support them during the crisis. Companies were particularly critical about what they saw as shortcomings in the banks’ processes for PPP loans. At the other end of the spectrum, smaller banks were winning plaudits and business from companies with their traditional “high-touch” service models to help clients apply for and secure SBA funding and otherwise navigate the crisis.

Commercial Banking Relationships Increasingly Concentrated with the “Big Three”

The Big Three Gain Ground

Today, the big three U.S. banks have recovered that lost ground and more. Over roughly a six-month period from late 2022 to about the end of Q1 2023, the big three U.S. banks grew their share of lead banking relationships from 26% to 30%.

Most of those gains came in the aftermath of the collapse of Silicon Valley Bank and First Republic. The historic failure of these two seemingly sound and growing institutions shook the confidence among clients in smaller banks. Deposits immediately began flowing from small and even regional banks into the perceived safety of the three “too-big-to-fail” universal banks. Although decisive action by regulators and banks prevented an actual run on these banks, these steps won’t be enough to reverse or even stop the increasing concentration of the U.S. banking industry in the hands of the big three.

In truth, the big three banks were winning back relationships lost during the pandemic well before the failures. With the effects of the pandemic fading and cheap credit still widely available, Bank of America, JPMorgan Chase and Wells Fargo began wooing back commercial banking clients in 2022. They did so in large part due to innovative technology platforms that delivered efficiencies for clients and helped address some of the “pain points” that have long made day-to-day banking a headache for companies. By combining this innovative technology with effective relationship-manager coverage, the universal banks have developed a model that smaller banks will be hard-pressed to match.

Generally, smaller banks have competed against larger rivals by delivering superior service. They achieved that reputation through high-touch models based on strong and intense relationship manager coverage. As commercial banking clients begin to emphasize the convenience and efficiencies of digital banking, smaller banks that lack the scale to supplement their RM coverage with top-quality technology offerings are struggling. Pressure will only increase from here as internal funding costs rise and banks face mounting competition from industry providers and nonbanks, including fintechs and private equity firms making inroads in commercial lending.

Industry Consolidation Ahead

We anticipate those pressures will trigger significant levels of merger and acquisition activity as small and regional banks strive to amass the resources and scale they need to go toe-to-toe with the big three. Accelerated M&A, combined with what we expect to be a slow but steady continued migration of commercial banking relationships to larger banks, will lead to further consolidation in the U.S. commercial banking industry.

Additional bank consolidation will not necessarily be detrimental to small businesses and midsize companies. Currently, more than 4,000 banks compete in the United States. Although that’s down from as many as 12,000 about 20 years ago, U.S. companies are hardly facing a shortage of options for credit or other commercial banking services.

In fact, many observers believe the U.S. remains “overbanked,” and that the current economics of the industry are not sufficient to support that many competitors. Expect the U.S. banking industry to move closer to an equilibrium of fewer, larger commercial banks.

Chris McDonnell, Cheri Derrick, and Kevin Seiler are the authors of this publication.

This entry is Part Three in our analysis of the competitive dynamics of the U.S. commercial banking industry. In this series, we pay special attention to the increasing economic pressure on regional and small banks. We began this analysis in Part One with an examination of client trust levels in commercial banking. In Part Two we looked at the new nonbank competitors that are moving aggressively to capture a share of the U.S. commercial banking market and assessed the possible implications for regional and small banks. In this final installment, we look at what we expect to be one of the main consequences of the pressure on smaller banks: industry consolidation.

The insights presented throughout this series come from the Greenwich Money in Motion platform. Money in Motion equips commercial bankers with unique, high-value client intelligence for the U.S. SME market derived from company-level data on approximately 1.3 million private companies, including wallet estimates, next-best product recommendations, attrition risk identification, wallet share analytics, and quality metrics for more effective prospecting, retention and pre-call planning.