The challenges posed by persistent inflation and elevated volatility are prompting U.S. institutional asset managers to rebalance both their portfolios and their priorities, according to the Coalition Greenwich 2022 U.S. Institutional Investors Study.

The 51st annual study covered over 700 institutional investors from almost 600 corporate, public, and endowment and foundation funds, with either pension or investment pool assets greater than $150 million.

Key Challenges for Institutional Investors

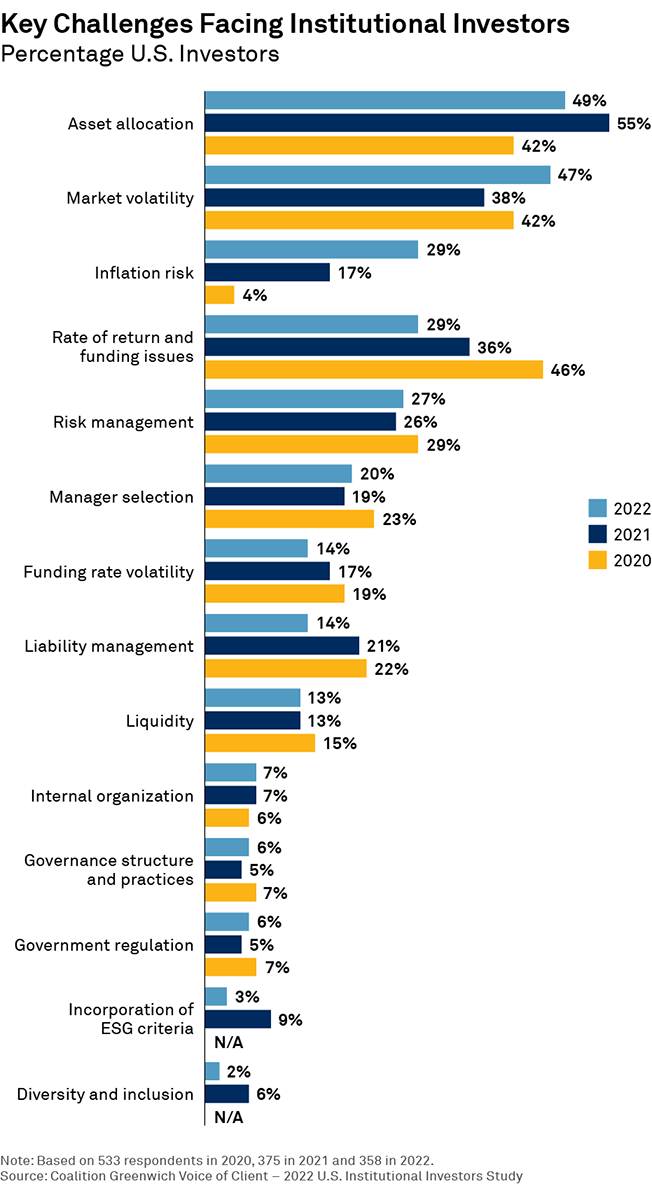

As the market shifted from the low-inflation, low-interest rate environment of 2020 and 2021 to a high-inflation and rising rates environment in 2022, investor concerns changed as well.

Institutional investors identified inflation risk, market volatility and asset allocation as the dominant challenges, while funding and liability management concerns eased, as the increase in interest rates helped close funding gaps. Within this uncertain climate, and a broader adoption of responsible investment concerns on environment, social, governance (ESG) and diversity, equity and inclusion (DEI) issues took a backseat.

Pension Funding Levels Rise Sharply

The upside to rising interest rates was the universal increase in pension plan funding levels, with corporate plan funding levels rising to almost historic highs. Public plan funding levels also benefited, although not to the same extent.

Manager Perception and Selection

At a time when the surge in inflation caused markets to move into bear territory, led by the collapse in tech stocks and the worst bond market in years, asset owners placed increased emphasis on performance, value from a fee perspective, risk-return profile, and capabilities while selecting investment managers.

Pricing was pivotal for investors across all channels. Corporate and public plans also looked at investment professionals’ willingness to accommodate customization, while endowments and foundations focused more on their expertise and ability to produce returns.

Over half the asset owners in the study also consider ESG and DEI as factors in manager selection.

Performance was the No. 1 factor for judging managers as best-in-class by brand. However, investor perceptions were also influenced by distinctive client service and the quality of thought leadership.

How are investors gaining familiarity with managers? Consultant advice and thought leadership count, as do managers’ websites, with over 70% of investors in North America reviewing the latter.

Conclusion

A tumultuous year in the markets has reshaped investors' concerns and their expectations for future allocations. Funding levels have improved, especially for corporate plans, and investors are looking for more from their managers in terms of knowledge and thought leadership.

The second half of this two-part blog will further explore how investors are adapting their hiring expectations, asset allocation, and OCIO and consultant usage to position themselves for success within the current market environment.