Despite the recent wild gyrations in global stock markets, 2015 could represent the calm before the storm for European equity brokers, which are awaiting word from regulators on new “unbundling” rules that could upend the economics of their...

Despite the recent wild gyrations in global stock markets, 2015 could represent the calm before the storm for European equity brokers, which are awaiting word from regulators on new “unbundling” rules that could upend the economics of their...

ConvergEx announced last week that it was euthanizing one of its two dark pools, VortEx. In the grand scheme of the equities market, this was hardly a headline grabber.

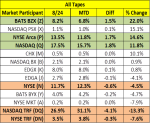

US equity markets are always touted as the poster child for electronic trading, but our most recent electronic trading study results (see chart below) prove that view is somewhat misguided.

A few weeks back I had a great conversation with Liquidnet’s head of Fixed Income trading and the head of InteractiveData’s evaluated pricing service.

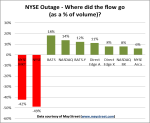

First of all, let’s give a nice round of applause to all market participants on Monday. And by nice I mean more like the warmhearted ovation from a "filmed before a live studio audience" sitcom as opposed to a genial, drops-a-2-footer-...

Some quick thoughts on market structure as we head into today's sell off.

As MiFID II turns up the pressure on the delineation of payment for research versus execution, institutional investors may soon increase their attention on brokerage services that materially enhance multiple aspect of their execution process.

No new swaps have been mandated to trade on SEFs since the original determinations were made two years ago. The CFTC recently called a panel to understand why and what they should do to change the logjam we are in the middle of now. We were...

The extended discussion surrounding the NYSE outage from last Wednesday seems your typical case of rubbernecking. Maybe it's wishful thinking that this event will fit neatly with the Flash Boys script, painting the US equity markets in...

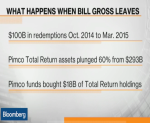

When Bill Gross left PIMCO many in the market were concerned that the expected outflows would crush bond prices as they were forced to sell.