The biggest FinTech story of last week was the announcement that not only had Digital Asset Holdings (DAH) raised $52mm in funding, but had also secured a strategic contract to develop distributed ledger (blockchain) settlement solutions for...

The biggest FinTech story of last week was the announcement that not only had Digital Asset Holdings (DAH) raised $52mm in funding, but had also secured a strategic contract to develop distributed ledger (blockchain) settlement solutions for...

There has been plenty of talk amongst the industry about the MiFID II rules aimed at bringing more transparency to dark pool trading venues across Europe. Regulators claim the lack of transparency and details around transactions is dangerous...

Equity trading trails the technological progress made in other industries. Although today’s US equity market structure is more complex, nuanced, and competitive than any other asset class, one could argue that the electronic tools offered traders...

The anniversary of the Treasury "flash crash" and next week's market structure meeting at the NY Fed has brought with it a renewed focus on the functioning of the US Treasury trading. In an effort to provider further clarity into how this...

Despite the recent wild gyrations in global stock markets, 2015 could represent the calm before the storm for European equity brokers, which are awaiting word from regulators on new “unbundling” rules that could upend the economics of their business...

ConvergEx announced last week that it was euthanizing one of its two dark pools, VortEx. In the grand scheme of the equities market, this was hardly a headline grabber. In this day and age where ATSs seem so similar, many sporting names...

US equity markets are always touted as the poster child for electronic trading, but our most recent electronic trading study results (see chart below) prove that view is somewhat misguided. Driven primarily by new rules requiring index CDS...

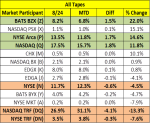

First of all, let’s give a nice round of applause to all market participants on Monday. And by nice I mean more like the warmhearted ovation from a "filmed before a live studio audience" sitcom as opposed to a genial, drops-a-2-footer-for...

Some quick thoughts on market structure as we head into today's sell off: 1) Volumes sure to be 12-15 billion if not higher. Can our venues truly handle this volatility/flow? 2) For years, we have been told about venue stress testing. Let's...

As MiFID II turns up the pressure on the delineation of payment for research versus execution, institutional investors may soon increase their attention on brokerage services that materially enhance multiple aspect of their execution process....

We are always here to help you