Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume...

Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume...

This was my first time chatting with Betty Liu at Bloomberg TV, which I really enjoyed. We discussed why the Fed shouldn't hyper focus on short term market volatility, how bond market liquidity has changed but a crisis isn't likely, and last but not...

The biggest FinTech story of last week was the announcement that not only had Digital Asset Holdings (DAH) raised $52mm in funding, but had also secured a strategic contract to develop distributed ledger (blockchain) settlement solutions for...

The anniversary of the Treasury "flash crash" and next week's market structure meeting at the NY Fed has brought with it a renewed focus on the functioning of the US Treasury trading. In an effort to provider further clarity into how this...

We recently published research examining how the market for trading US Treasuries has changed and is likely to change in the coming years (U.S. Treasury Trading: The Intersection of Liquidity Makers and Takers). But while market participants...

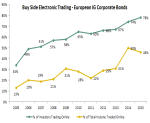

US equity markets are always touted as the poster child for electronic trading, but our most recent electronic trading study results (see chart below) prove that view is somewhat misguided. Driven primarily by new rules requiring index CDS...

A few weeks back I had a great conversation with Liquidnet’s head of Fixed Income trading and the head of InteractiveData’s evaluated pricing service. Both firms provide tools to the market that hope to improve transparency and ultimately lubricate...

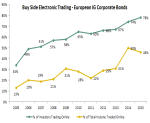

When Bill Gross left PIMCO many in the market were concerned that the expected outflows would crush bond prices as they were forced to sell. This turned out to not be the case, and we shouldn’t really be surprised. Major market participants like...

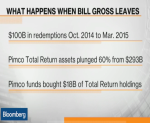

We recently published new research examining the use of Fixed Income ETFs by institutional investors. Our analysis found that the increasing acceptance of ETFs as an institutional (rather than retail) investment tool coupled with challenged...

A crisis is a crisis because most people didn't see it coming. Unexpected events freaks people out causing a bad chain of events - a crisis. So despite evidence that a liquidity crisis is on the horizon in the bond market, wide spread recognition...

We are always here to help you