Interviews earlier this year with nearly 60 global bond investors found that more than expected - 29% - either currently make prices in the corporate bond market or plan ton do so in the next 12 months. In and of itself this finding...

Interviews earlier this year with nearly 60 global bond investors found that more than expected - 29% - either currently make prices in the corporate bond market or plan ton do so in the next 12 months. In and of itself this finding...

Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume...

The corporate bond market is starting to feel a lot like the swaps market did in 2010. There is no electronic trading mandate for corporate bonds of course, but a proliferation of new bond trading platforms and initiatives is upon us akin to...

Market structure happenings have been fast and furious since 2009, and 2014 did not disappoint. Mandatory SEF trading finally began, fixed income electronic trading continued its steady incline, the current shape of the US equity market was...

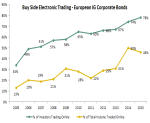

The penetration of electronic trading across the financial markets is remarkably inconsistent. While equities and foreign exchange are largely traded over platforms, the same cannot be said for much of the fixed income market. Over-the-...

I spent most of my summer digging through our 2014 North American fixed income data looking to see what's changed in the past year and what's the come. While the bulge bracket continues to dominate rates, mid-tier brokers are making some...

Last week I did an interview with the guys at DerivAlert about where we've come and where we're going. The result was a pretty concise overview of our thoughts on SEFs, US Treasury's, corporate bonds and European regulatory reform, so we...

Capital is expensive and getting more expensive. But the problem is proving a much harder one to manage in Europe, with European banks continuing to deleverage and already complying with the principles of Basel III while US banks have their capital...

We all know that the massive reduction in dealer inventories and the cost of capital has had a huge negative impact on liquidity in the corporate bond market. While the primary market has helped soften the blow, that crutch isn’t going to be here...

We are always here to help you