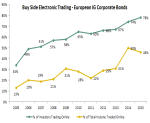

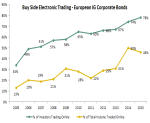

Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume...

Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume...

Another year down. We're a year further from the Lehman bankruptcy, a year further from the signing of Dodd-Frank and a year closer to the full implementation of Basel III. But before we start looking ahead, let's look back at the year in market...

Last week I did an interview with the guys at DerivAlert about where we've come and where we're going. The result was a pretty concise overview of our thoughts on SEFs, US Treasury's, corporate bonds and European regulatory reform, so we...

Capital is expensive and getting more expensive. But the problem is proving a much harder one to manage in Europe, with European banks continuing to deleverage and already complying with the principles of Basel III while US banks have their capital...

The year 2013 will likely go down as the year of mandatory clearing. Once ignored by eager financial market Greenwich Associatesprofessionals as boring back-office stuff, collateral management, credit limits and all other things clearing stood front...

We are always here to help you