From a fund type perspective, it should come as no surprise that hedge funds - nearly 90% of those in our study - use derivatives, above the roughly 60% of asset managers that do the same. Their leveraged approach to investing coupled with...

From a fund type perspective, it should come as no surprise that hedge funds - nearly 90% of those in our study - use derivatives, above the roughly 60% of asset managers that do the same. Their leveraged approach to investing coupled with...

0838.png?itok=sLnBfbfR)

Last week I attended the sold-out Empire Startups FinTech conference in NYC. From the moment I walked in I realized this was not your typical stop on the conference circuit. The venue was Webster Hall – a downtown nightclub venue repurposed for...

5fbe.png?itok=r9po0cRB)

I can’t say I was ever really a fan of Joan Armatrading, but her 1983 hit “Drop the Pilot” comes to mind following the Equity Market Structure Advisory Committee’s (EMSAC) recommendation for an Access Fee Pilot Program. Maker-taker pricing refers...

Interviews earlier this year with nearly 60 global bond investors found that more than expected - 29% - either currently make prices in the corporate bond market or plan ton do so in the next 12 months. In and of itself this finding...

In my first blog post on the evolving blockchain technology landscape I wrote about how, following the hype of 2015, this year would see technology companies and financial services firms explore different ways to use the blockchain technology in...

I recently participated in a great panel discussion with James Jockle from Numerix and Kazu Yokokawa from the Nomura Research Institute. I look forward to getting an update from Kazu on the POCs they are working on!

Richard Johnson, Greenwich Associates vice president of market structure and technology, discusses the results of the firm's survey of 256 buy-side traders around the world. He speaks with Bloomberg's Alix Steel on Bloomberg Markets. Bloomberg...

An important, but little understood feature of US market structure is the operation of National Market System (NMS) Plans. NMS Plans came about through the 1975 Amendments to the Securities and Exchange Act, and essentially provide a mechanism for...

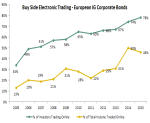

Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume...

This was my first time chatting with Betty Liu at Bloomberg TV, which I really enjoyed. We discussed why the Fed shouldn't hyper focus on short term market volatility, how bond market liquidity has changed but a crisis isn't likely, and last but not...

We are always here to help you