Market Data Spending Is on a Roll

Spending on market data is going up across the board.

Spending on market data is going up across the board.

OTC derivatives clearing has been en vogue for the past 15 years, but the foreign exchange (FX) market hadn't gotten the memo.

The corporate bond market in Europe, which for this research includes bonds issued by European and U.K.-based corporate issuers, saw $11 billion in notional volume traded each day on average in the first half of 2023.

Has the practice of engaging investment consultants changed in recent years or do the same tried-and-tested principles still apply? Are there different strategies and tactics that managers should now be employing to maximize relationships with...

In 1Q23, Coalition Index Investment Banking revenues decreased (9)% on a YoY basis.

The investment management industry is managing through tumultuous times. The list of challenges is extensive, ranging from regulation to rapidly rising interest rates to market volatility.

Changing fixed-income market dynamics are causing traders to rethink their execution strategies and technology.

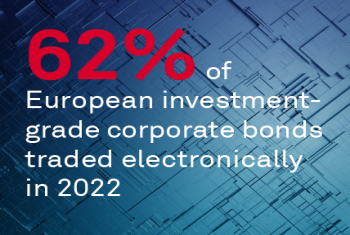

Global bond markets have experienced a dramatic adoption of electronic trading tools over the past decade, led largely by developed markets in the U.S. and Europe.

Coalition Greenwich, in a collaboration with SIX Group, interviewed 79 global buy-side and sell-side firms to confirm what drives their choice of market data vendor, what types and frequency of data these firms are buying and consuming, and their...

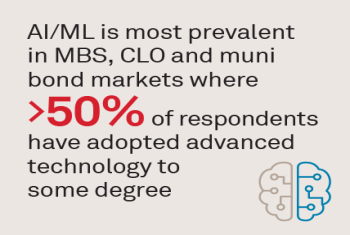

Artificial intelligence (AI) and machine learning (ML) have been buzzing for some time.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder