Northern Lights: Illuminating Trends in Canadian Equities

The Canadian equities market is undergoing a transformation marked by an embrace of electronic trading with an onus on sourcing liquidity in difficult-to-trade small and mid-cap names.

The Canadian equities market is undergoing a transformation marked by an embrace of electronic trading with an onus on sourcing liquidity in difficult-to-trade small and mid-cap names.

In this report, we identify the Top 5 trends to watch in banking in 2024 and provide our perspective on how each of these trends will impact commercial banks and their clients.

The U.S. equity trading landscape is a theater of evolution.

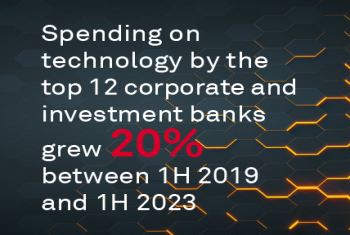

Investment banking profits are a two-sided coin. Revenues often make the headlines, but it can be reductions in spending that increasingly drive profitability.

When it comes to sustainability, companies and banks are in desperate need of solid data. Growing numbers of large corporates are adopting net-zero targets and other sustainability goals. As they do so, management teams and boards of directors are...

The accelerating pace of change in institutional investment markets is placing a premium on asset manager agility. The asset management business is being transformed by a host of powerful trends, including soaring interest rates, increased...

Coalition Greenwich examines 10 of the biggest market structure trends they will be watching in the new year.

In 3Q23, Coalition Index Investment Banking revenues were down by (1)% on a YoY basis.

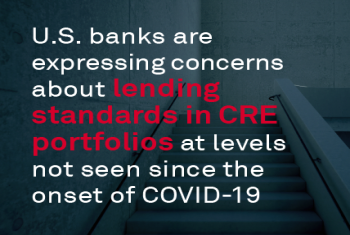

Risk levels and delinquencies are climbing in commercial real estate loans, and U.S. banks are expressing concerns about lending standards in CRE portfolios at levels not seen since the onset of the global pandemic.

The current U.S. investment environment is characterized by very high interest rates, inflation and unpredictable market volatility.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder