FY22 Coalition Index Investment Banking revenues fell (13)% on a YoY basis.

FY22 Coalition Index Investment Banking revenues fell (13)% on a YoY basis.

The contribution of U.S. Commercial Banking to the total revenue pool has steadily decreased since FY19. This trend reversed in FY22 due to outperformance across products compared to CIB.

In 2022, inflation, rising interest rates and other macroeconomic headwinds replaced pandemic disruptions as the key challenges facing institutional investors in Japanese equity markets.

This Greenwich Report explores several drivers of investment in surveillance technology. These range from the system upgrades via new technology, better data, more analysis tools and methods, and connecting disparate systems and information.

Transaction Banking Revenues reached a decade high in FY22, driven by robust growth in Cash Management, while Trade Finance grew moderately.

Despite economic headwinds around the world, large companies in the Middle East and North Africa remain extremely positive in their outlook, with attention and resources focused on expanding and diversifying businesses, and growing revenues.

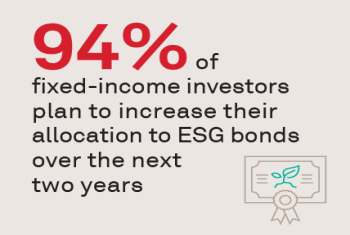

ESG is one of the more ubiquitous topics in asset management, yet inconsistencies around taxonomies, data and regulation means the impact is fluid.

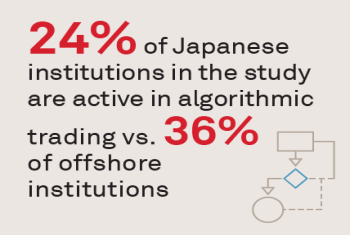

Japanese institutions are embarking on an ambitious plan to remake their investment portfolios by significantly expanding allocations to alternative asset classes. That transformation is introducing a new level of complexity that will eventually...

Reduced commission rates, constrained budgets and smaller team sizes have left both asset managers and brokers facing greater pressure to automate their trading workflows and accomplish more with less.

Securities Services Index Revenues expanded in all regions, particularly in Americas and APAC where Net Interest Income grew significantly.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder