A reduction in systemic risk is one great benefit of global financial reform; another is the increasing volume of data made available to market participants and observers. Even still, finding and deciphering that public data is often easier...

A reduction in systemic risk is one great benefit of global financial reform; another is the increasing volume of data made available to market participants and observers. Even still, finding and deciphering that public data is often easier...

Market structure changes in the bond market appear to be happening organically. Shocking I know. Rewind back seven years to 2007. Market structure research was primarily focused on technology innovation, evolving business models and a...

I'm of the belief that the regulatory changes with the biggest long term impact are those related to the cost of capital. Basel III, CRD IV and whatever the US regulators ultimately decide will prove to be both the carrot and the stick...

I spent most of my summer digging through our 2014 North American fixed income data looking to see what's changed in the past year and what's the come. While the bulge bracket continues to dominate rates, mid-tier brokers are making some...

On October 2 market participants requesting price quotes for an order via a SEF will have to ask a minimum of three dealers to respond rather than the current minimum of two (although in neither case are those dealers required to respond to the...

According to Liquidnet CEO Seth Merrin the corporate bond market is “a disaster waiting to happen”. A disaster? Maybe. But certainly it is a market waiting for better ways to match buyers and sellers. That is exactly what Liquidnet was thinking...

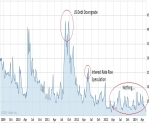

Its a little sad how excited I get about charts. Maybe its because they do such a good job telling a complex story, or maybe because looking at a chart is easier than reading - but I digress. Another great view of the fixed income world...

Those of us tracking the broader fixed income market have become quite familiar with the chart showing dealer inventories of corporate bonds falling through the floor, but this chart of bank US Treasury holdings totally blew me away. Source:...

I'm a little obsessed with volatility lately - well, the lack of it actually. The VIX has been hovering around 12 for months despite emerging markets turmoil, rigging scandals and regulatory environment that can only be described as volatile....

Liquidity in the corporate bond market is tough. We've written about it time and time again. At a high level we see two solutions. One, inject new electronic trading tools and liquidity providers into the existing corporate bond...

We are always here to help you